It’s difficult to know who is going to commit fraud at a company. In 89% of internal fraud cases (fraud committed by employees of a company), the perpetrator was never previously charged or convicted of a fraud-related offense. So there is very little direct evidence that someone is more likely to commit fraud when they come to work for you.

That is why we look for red flags… signs that someone may be more likely to engage in fraud. We call these personal red flags of fraud, and there are literally hundreds of them that could indicate a greater propensity toward fraud. While companies have to be careful in the hiring process to not discriminate against protected classes, they most certainly can consider legal troubles (particularly of a financial nature) when hiring someone who is going to have access and/or control over budgets and money.

This topic came to my attention as the City of Milwaukee encounters an interesting turn in their quest to hire a new Health Commissioner. One of two finalists for the position, Jeanette Kowalik, has had some significant financial troubles that were reported yesterday in the local newspaper. Ms. Kowalik filed for Chapter 7 bankruptcy in both 2003 and 2014. Chapter 7 bankruptcy allows the filer to clear unsecured debts, but not debts secured with collateral (like a home) or student loans. She also lost a home to foreclosure in 2014.

The issue is being raised because the Health Department has had its share of troubles, and the person hired for the commissioner position would be responsible for a budget of $21.7 million.

Ms. Kowalik issued a statement saying that she was “hit by the national foreclosure crisis” after she bought her first home in 2007 and “was impacted by the recession.” She says she has recovered from her financial troubles, and that they didn’t affect her leadership capabilities, which included managing million dollar budgets.

That sounds nice and reasonable, but if you dig into the March 2014 bankruptcy filing of Jeanette Kowalik, you find some troubling things.

- Her assets included two timeshares in Orlando. One was purchased in 2011, and one in 2013. Her statement blames the 2014 bankruptcy on her home purchase in 2007 and the recession. Yet she was getting her Phd between 2007 and 2013, buying two timeshares, and being affected by the recession? She was also employed as a Program Director for the Chicago Department of Public health in 2013 and 2014. Something doesn’t add up here about her financial situation and/or her judgment in buying timeshares while she was allegedly having money troubles and/or blaming the recession.

- She listed unsecured debts of $218,084, which included $170,682 in student loans. That’s a staggering amount of money. She is listed at having a bachelor’s, masters, and PhD. The education is commendable, but was the cost worth it? Let’s set this one aside, even though it should raise some eyebrows.

- The debts include nearly $28,000 in credit card debt including retailers such as Neiman Marcus & Bloomingdales, with the last usage of the credit accounts two months before the bankruptcy filing. I question the judgment of someone who says their financial troubles are caused by a house and the recession, yet she’s shopping at high end retailers using credit cards.

- Also on the list of debts is over $11,000 owed to Springleaf Financial Servicing for a debt incurred in December 2013. Prior debts with the company were incurred in 2006, 2007, and 2008. The company does personal loans. It is questionable that a loan was incurred with them three months prior to filing bankruptcy.

- Ms. Kowalik’s annual wages are listed at $66,564, plus $18,000 per year net rental income (rent received less expenses for the property). Her listed monthly expenses exceed this income. This leaves no money to pay the credit card debts or personal loan, much less student loans. I would question the judgment of someone using credit cards and personal loans, knowing she will be unable to repay them.

So what does this all mean as it relates to the personal red flags of fraud? When looking at behavioral red flags, one common issue is the lifestyle of the subject. Does the person lead a lifestyle that is unsustainable with her current sources of income? If so, she needs to fund that deficit somehow. While the 2014 bankruptcy may have fixed an immediate problem, I think the spending in excess of the income is a problem even if it was in the past. Can she be trusted to make good financial decisions for the organization first and foremost? And second, could she get herself into financial trouble again that could create a risk factor for fraud?

Someone with a history of financial troubles may be more susceptible to the temptation of fraud when placed in charge of money. That’s not to say it happens always (or even often), but it is simply more likely. When we see someone with not one, but TWO personal bankruptcies, we have to consider whether there is a pattern of irresponsible financial behavior.

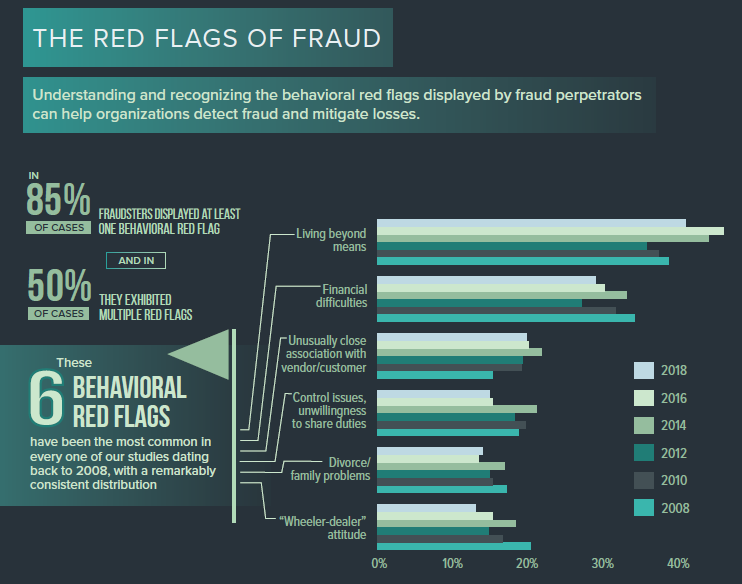

Background checks on people who would be responsible for managing money and overseeing budgets are important. They can uncover relevant information about someone’s financial background and behavior, and clues about what could happen in the future. The most common behavioral red flag seen in perpetrators of fraud is living beyond one’s means. The next most common red flag is financial difficulties. These are issues that should not be taken lightly.