SUPREME COURT OF WISCONSIN

SUPREME COURT OF WISCONSIN

CASE NO.: 2006AP578-D

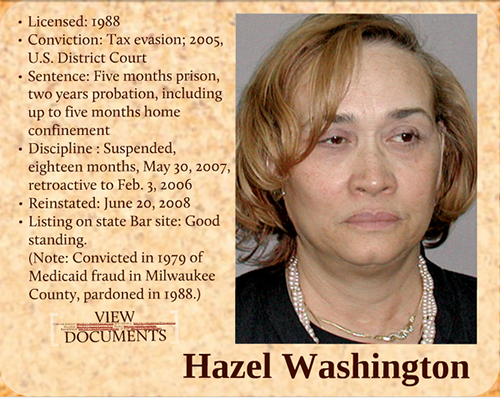

COMPLETE TITLE: In the Matter of Disciplinary Proceedings Against Hazel J. Washington, Attorney at Law:

Office of Lawyer Regulation, Complainant, v. Hazel J. Washington, Respondent.

OPINION FILED: May 30, 2007

David R. Schanker

Clerk of Supreme Court

ATTORNEY disciplinary proceeding. Attorney’s license suspended.

¶1 PER CURIAM. We review the report and recommendation of the referee following the entry of a stipulation by the Office of Lawyer Regulation (OLR) and Attorney Hazel J. Washington. As requested by the stipulation, the referee recommended that Attorney Washington’s license to practice law in Wisconsin be suspended for one year, effective February 3, 2006, the date on which Attorney Washington’s license was summarily suspended due to her criminal conviction.

¶2 On January 10, 2007, after reviewing the referee’s recommendation, this court issued an order directing the parties to show cause why the discipline to be imposed should not be an 18-month suspension. The OLR and Attorney Washington each filed a written response maintaining that the one-year suspension contemplated by their stipulation would be appropriate discipline.

¶3 After consideration of the facts of this case and the parties’ responses to the order to show cause, we conclude that an 18-month suspension of Attorney Washington’s license to practice law in this state is necessary to reflect the serious nature of her professional misconduct. We agree with the recommendation of the referee that this suspension should be deemed to have commenced on the date of the summary suspension of Attorney Washington’s license pursuant to SCR 22.20. Finally, we conclude that Attorney Washington should pay the costs of this disciplinary proceeding, which were $488.14 as of December 5, 2006.

¶4 Attorney Washington was admitted to the practice of law in Wisconsin in June 1988. She has not been the subject of discipline prior to the proceedings in this matter. She has most recently practiced in Milwaukee.

¶5 This disciplinary proceeding grew out of Attorney Washington’s guilty plea and conviction for attempting to evade and defeat the payment of a large portion of her federal income taxes for 1998.

¶6 According to Attorney Washington’s plea agreement, which was filed without objection in this court in connection with a motion for the summary suspension of her license, she used the same individual as the accountant and tax preparer for both her legal practice, Washington Law Offices, Inc., and for her personal affairs. Attorney Washington was to give the accountant the monthly statements and canceled checks from her firm’s client trust accounts, business checking account and business payroll account. The accountant used these items to calculate Attorney Washington’s income and to generate general ledgers, payroll reports and financial statements, which the accountant regularly reviewed with Attorney Washington.

¶7 The accountant used the general ledger and a list of itemized deductions provided by Attorney Washington to prepare Attorney Washington’s business and personal tax returns. Although the accountant reminded Attorney Washington of the need to capture all income, Attorney Washington never advised the accountant of any additional income beyond that shown on the business account statements (with a minor exception irrelevant to this opinion).

¶8 For 1998, Attorney Washington claimed gross receipts of $591,725, listed $40,136 in total income, and showed income tax due of $8930. Attorney Washington’s receipts, income and tax due were actually much higher because she deposited at least $93,514 in legal fees into a personal account that she never disclosed to the accountant. Attorney Washington then used these hidden monies to pay for personal expenses. Attorney Washington also “signed over” checks payable to her law practice to her personal mortgage lender without disclosing them to the accountant so that the funds would not show up on her business records or her tax return. In total, Attorney Washington had unreported gross income in 1998 of more than $100,000, causing a tax loss to the federal government of more than $31,000.

¶9 The federal criminal records also showed that Attorney Washington engaged in similar conduct in 1999 and 2000, although the federal government chose not to charge her with tax evasion for those years. For those two years, Attorney Washington had additional unreported income of more than $100,000. Although she was not convicted of criminal offenses for those two years, Attorney Washington has admitted her unlawful conduct.

¶10 Pursuant to the plea agreement, Attorney Washington pled guilty to one count of attempting to evade and defeat payment of a large portion of her federal income tax liability for 1998. The United States District Court for the Eastern District of Wisconsin subsequently sentenced Attorney Washington to five months in prison and two years of supervised release, 150 days of which were required to be served in home confinement.

¶11 After Attorney Washington entered her guilty plea, the OLR filed a motion seeking the summary suspension of Attorney Washington’s license to practice law in this state pursuant to SCR 22.20(1).1 On January 27, 2006, this court summarily suspended Attorney Washington’s license, effective as of February 3, 2006.

¶12 Pursuant to SCR 22.20(6),2 the OLR then filed a complaint that alleged in a single count that Attorney Washington had violated SCR 20:8.4(b).3 After Attorney Kathleen Callan Brady was appointed to serve as the referee in this matter, the OLR and Attorney Washington filed a stipulation. In the stipulation Attorney Washington admitted that by pleading guilty to and being convicted of willfully attempting to evade and defeat a large portion of the federal income tax due and

(1) Summary suspension. Upon receiving satisfactory proof that an attorney has been found guilty or convicted of a serious crime, the supreme court may summarily suspend the attorney’s license to practice law pending final disposition of a disciplinary proceeding, whether the finding of guilt or the conviction resulted from a plea of guilty or no contest or from a verdict after trial and regardless of the pendency of an appeal.

2 SCR 22.20(6) Summary license suspension on criminal conviction provides:

(6) Filing of complaint. The director, or special investigator acting under SCR 22.25, shall file the complaint in the disciplinary proceeding within 2 months of the effective date of the summary suspension or shall show cause why the summary suspension should continue. The respondent attorney may file a response with the supreme court within 10 days of service. Reinstatement under this section does not terminate any misconduct investigation or disciplinary proceeding pending against the attorney.

3 SCR 20:8.4(b) states that it is professional misconduct for a lawyer to “commit a criminal act that reflects adversely on the lawyer’s honesty, trustworthiness or fitness as a lawyer in other respects.”

owing by her and her husband for 1998, she had committed a criminal act that reflects adversely on her honesty, trustworthiness or fitness as a lawyer, in violation of SCR 20:8.4(b). The stipulation states that the OLR recommends, and Attorney Washington agrees, that an appropriate level of discipline would be a one-year suspension of Attorney Washington’s license to practice law in this state.

¶13 On the basis of the stipulation, the referee found that all of the factual allegations in the OLR’s complaint had been proven and concluded that Attorney Washington had violated SCR 20:8.4(b). The referee recommended the one-year suspension requested by the parties, retroactive to the date of the summary suspension of Attorney Washington’s license. In addition, she recommended that the court order Attorney Washington to pay the costs of the disciplinary proceeding.

¶14 As noted above, after considering the referee’s recommendation, on January 10, 2007, this court issued an order to the parties to show cause why the suspension should not be for a period of 18 months.

¶15 The OLR and Attorney Washington both filed responses that continued to argue in favor of a one-year suspension. The OLR’s response stated that it had considered a number of cases that it believed to be somewhat similar to the facts of the present case, although it acknowledged that no Wisconsin case is directly on point. For example, it argued that Attorney Washington’s misconduct was not as serious as the conduct that supported a stipulated 18-month suspension against Attorney Mark

Brown. In re Disciplinary Proceedings Against Brown, 2005 WI 49, 280 Wis. 2d 44, 695 N.W.2d 295. In that case, Attorney Brown admitted that he had converted to his personal use over $16,000 in fees belonging to his law firm, had failed to report fee income on his personal income tax return, had made multiple misrepresentations to his law partner and associate, and had made misrepresentations to the OLR. Id., ¶¶13-14.

¶16 The OLR asserted that the present case was similar to In re Disciplinary Proceedings Against Hausmann, 2005 WI 131, 285 Wis. 2d 608, 699 N.W.2d 923 (one-year suspension due to federal conviction for conspiracy to commit mail and wire fraud, where attorney had no prior discipline and a record of community service), and In re Disciplinary Proceedings Against Brown-Perry, 2003 WI 151, 267 Wis. 2d 184, 672 N.W.2d 287 (stipulated one-year suspension for multiple counts of misconduct, including failing to place client funds in trust, failing to return unearned retainer fees, failing to forward settlement funds to a client, using client funds for personal expenses, failing to cooperate with the OLR, and failing to file income tax returns for a number of years).

¶17 The OLR acknowledged, however, that in another case involving a single conviction for federal tax evasion, the decision in which is being released on the same date as this opinion, it was recommending a three-year suspension. In re Disciplinary Proceedings Against Phillips, No. 2006AP334-D (Phillips II). In that case, Attorney Phillips hid the proceeds of a $125,000 loan by converting the funds to cashier’s checks and negotiating them through his client trust account and a separate bank account maintained by his wife so that the Internal Revenue Service (IRS) could not attach the funds to pay past income tax liabilities. The OLR attempted to distinguish its recommendation in Phillips II by noting that Attorney Phillips had previously received a one-year suspension and that he had a long-standing pattern of failing to file income tax returns and to pay the taxes due. See In re Disciplinary Proceedings Against Phillips, 2006 WI 43, 290 Wis. 2d 87, 713 N.W.2d 629 (Phillips I) (one-year suspension imposed for improperly obtaining loans from client, failing to act with reasonable diligence, failing to return client files and failing to file state income tax returns).

¶18 Attorney Washington’s response noted that the sanction imposed in disciplinary proceedings involving tax-related misconduct has ranged from reprimands to revocation. She argues that because of mitigating factors in her case, including the lack of a prior disciplinary history, her voluntary entry of a guilty plea, her self-reporting to and cooperation with the OLR, and the lack of direct harm to her clients, the discipline should be on the lower end of the spectrum.

¶19 On the basis of the documentary evidence of Attorney Washington’s federal conviction for tax evasion and the parties’ stipulation, we determine that the referee’s factual findings are well-founded. We also agree with the referee’s conclusion that the facts prove that Attorney Washington committed a criminal act that reflects adversely on her honesty,

trustworthiness and fitness as a lawyer, in violation of SCR 20:8.4(b).

¶20 With respect to the appropriate level of discipline for an attorney’s criminal conviction that violates SCR 20:8.4(b), we have previously stated that each such case “must be assessed on the basis of its own facts.” Hausmann, 285 Wis. 2d 608, ¶23; see also In re Disciplinary Proceedings Against Widule, 2003 WI 34, 261 Wis. 2d 45, 660 N.W.2d 686 (court imposes appropriate disciplinary sanction regardless of referee’s recommendation).

¶21 In the present case, we determine that the serious nature of Attorney Washington’s prolonged course of hiding her income and filing false tax returns renders the requested one-year suspension inadequate. We conclude that Attorney Washington’s misconduct requires an 18-month suspension of her license to practice law in this state.

¶22 This was not a situation where an attorney inadvertently omitted on one or two occasions to record a fee in the financial records of her law firm or failed to file an income tax return. According to her federal plea agreement, Attorney Washington on multiple occasions deposited fee income directly into her personal account so that her accountant did not record the income on the books of her law firm. Although her accountant reminded her each year that all fee income had to go through the firm’s business accounts to be captured on her tax return, Attorney Washington hid her income and signed intentionally false tax returns. Indeed, although her 1998 tax

return showed total income of only approximately $40,000, she told potential creditors and others that her salary for that year was $130,000. Moreover, this misconduct was not limited to a single year. Attorney Washington admittedly engaged in this fraudulent course of conduct for at least three years, resulting in unreported income of over $200,000. She did not stop until the IRS sent her an audit notice in 2001.

¶23 While each disciplinary case does turn on its own facts, we do not agree with the OLR’s assertion that this course of conduct is less egregious than the conduct in Brown, 2005 WI 49. The attorneys in both cases engaged in deceptive conduct on multiple occasions over an extended period of time, with Attorney Washington converting to her own personal use a substantially greater amount of money (which in this case properly belonged to the federal government).

¶24 We also believe that a one-year suspension in this case would pose too great a disparity with the three-year suspension we impose today in Phillips II. Although we recognize that Attorney Phillips, unlike Attorney Washington, was the subject of prior discipline, both are being disciplined for engaging in federal tax evasion. With the 18-month suspension we impose on Attorney Washington, she still is receiving a suspension that is half as long as the 3-year suspension that Attorney Phillips is receiving.

¶25 Finally, we agree with the parties’ request and the referee’s recommendation that the suspension of Attorney Washington’s license should be deemed to have commenced on

February 3, 2006, the effective date of the summary suspension of her license. We also agree that Attorney Washington should pay the costs of this disciplinary proceeding.

¶26 IT IS ORDERED that the license of Attorney Hazel J. Washington to practice law in Wisconsin is suspended for a period of 18 months, retroactive to February 3, 2006.

¶27 IT IS FURTHER ORDERED that within 60 days of the date of this order, Attorney Washington shall pay to the Office of Lawyer Regulation the costs of this proceeding. If the costs are not paid within the time specified and absent a showing to this court of her inability to pay those costs within that time, the license of Attorney Washington to practice law in Wisconsin shall remain suspended until further order of this court.

¶28 IT IS FURTHER ORDERED that to the extent she has not already done so, Attorney Washington shall comply with the provisions of SCR 22.26 concerning the duties of a person whose license to practice law in Wisconsin has been suspended.

¶29 LOUIS B. BUTLER, JR., J., did not participate.