Family law cases involving complex financial issues often require the assistance of a financial expert for the following issues: Preparing a financial disclosure, including creating a marital balance sheet Comparing balance sheets from period-to-period to evaluate changes in assets and […]

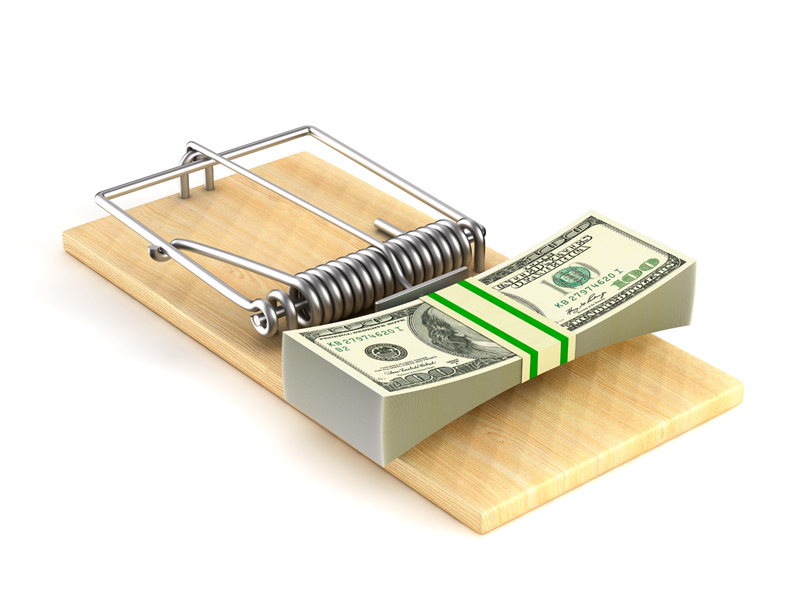

Firms of all sizes are interested in expanding their practices to include forensic accounting and fraud investigation. Experts agree: This practice area is growing and will continue to grow for the foreseeable future. Yet adding forensic accounting to a firm’s […]

Tracy talks about calculating damages for wage losses. These situations may include wrongful termination, wrongful death, or time lost from work due to an accident. She gives a helpful list of the types of damages that might be included.

When companies have big problems, they usually bring out the big guns. The benefits of using large law firms, audit firms, and other professional service firms are undeniable. These firms offer a depth of experience that is invaluable, and they […]

With the challenging economy we’re experiencing, people are constantly asking me how business is going. The assumption is that people and companies don’t have money for litigation, and so my business is probably suffering. Add to that the long-term shutdown […]

When a business owner or executive encounters proof of a fraud-in-progress, a natural reaction is often to immediately begin investigating. After all, someone has to get to the bottom of the situation. Yet that’s not usually the best way to […]

Tracy Coenen talks with Miles Mason, Esq. about a divorce case of his in which a forensic accountant was able to find significant financial frau d.

I receive many requests for information on the field of forensic accounting, including questions on courses of study, certification, job opportunities, and preparing for a career. Here are a few quick tips: Establish a background in general business and finance/accounting. […]

Forensic accounting existed quietly for a long time before the general public started to become aware of it. Twenty years ago when the frauds of Enron, WorldCom, and Tyco became big news, the work of forensic accountants was finally given […]

Do you audition for paid work? A forensic accountant does a preliminary analysis for free. An author writes an article for free. A professional speaker gives a speech or facilitates a session at a conference for free. We can probably […]