I’ve written about finding hidden income in divorce cases, as well as performing a lifestyle analysis to prove that there are hidden earnings. The concealment of assets and earnings in a divorce case is a hot-button issue. It is important to get your arms around these issues early if you are to have a good chance of finding the money and getting your share of the money.

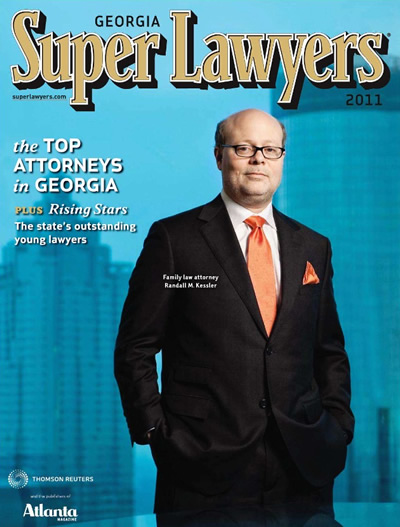

Randy had this advice about doing discovery early on financial items:

Well, there are a lot of ways that you can uncover assets. I mean, I know lawyers are going to be listening to this and “discovery, discovery, discovery.”

But it’s not as much discovery, it’s targeted discovery. And most importantly, quick discovery. You know, we all have the right to subpoena bank records. And a lot of lawyers will wait until the husband or the wife fails to provide tax returns and bank account records and credit cards.

The simplest thing to do is to immediately subpoena the records, before the spouse can close accounts or interfere with it. And then do the discovery to the spouse, so that you see what they don’t produce and why they don’t produce it. And you’ve already caught them when they miss the April bank statement, which is the one where they transferred the $250,000 out.

It’s an easy answer. It’s an obvious answer, but it’s an important answer, which is: targeted discovery. And the most important investigator, the most important spy that exists in any case, is the client.

Clients know so much more about their spouse than we will ever know. They know more about their spouse than the banker will know. They know their tendencies. And just talk with your client and ask them, “What does he do? Who does he trust? Who did he talk to about his money?” Take an immediate deposition of his best friend or the person that he relies on for financial advice, casual or otherwise. The person he golfs with. I think it’s not as much what you do, but when you do it.

And so many lawyers wait until the process unfolds. And they do the standard, typical, boilerplate discovery and then three months into the case, after they finished the other trials that they’ve had waiting for years to try, they start focusing on this case. And the defensive party, the rich party, the moneyed party has already manipulated and covered and moved and transferred.

So I think more importantly then how you do it is, do it from the start. You are going to have to do it anyway. Why not do it right at the get-go?

I cannot stress enough how right Randy is about this. I have been involved in several divorce cases in which counsel waited to subpoena records from banks and credit card companies, thinking the other side would voluntarily turn over the documents. A year or two later, no records were received, so subpoenas go out.

That is plenty of time for banks to merge, get shut down, change document formats, or lose records all together. The longer you wait, the more problems you may encounter in getting the documents from a bank. Your best bet is to do discovery early so you can preserve the evidence for use in the case.

More important can be what we will find in those bank and credit card records. The attorney has subpoenaed the known accounts. The detailed records may provide information on other secret, undisclosed accounts or assets that may exist. You need time to track those things down. If you wait until late in the case to do the subpoenas, then wait for your forensic accountant to do the analysis…. you may not have enough time to fully investigate other accounts and assets that are uncovered.

3 Comments

Leave a Reply

My husband recently passed an someone is signing his name to his bank an checks ect can I supeono his bank an other record s with out an attorney

I’m not an attorney, but whoever is in charge of his estate should be able to get the information from the bank without a subpoena. In order to issue a subpoena, there would have to be a lawsuit filed.

My mother’s co executors have resigned. The judge has now given me the rights to seek information I would like before closing our mother’s estate. My mother’s monies were deposited in an account in my sister’s name. Do I have the rights to ask the bank to provide me with information on this account if my sister’s name is the only name appearing on the account? My sister was co executor with my brother and neither one of them will provide me with any documents that they have as evidence to support their clam of our mother’s estate. The judge has not demanded them from the former co executors regardless the number of times I have requested from them and the courts. I feel Medicaid fraud has taken place and the judge is not seeing the full picture.