In July, critics attacked Groupon (GRPN) and it use of a made-up accounting measure management called Adjusted CSOI. I suggested that the company made up the measure to exclude many of the company’s expenses to make the company look more successful.

In July, critics attacked Groupon (GRPN) and it use of a made-up accounting measure management called Adjusted CSOI. I suggested that the company made up the measure to exclude many of the company’s expenses to make the company look more successful.

There was more to the story, however, as the Grumpy Old Accountants revealed Generally Accepted Accounting Principles (GAAP) violations in reporting revenue. Essentially, Groupon was recording more than twice the amount of revenue it should have been reporting under GAAP. The Grumpies explained:

This means that if the Company sells a coupon for $40 promising $80 in services, it records the entire $40 as revenue, despite its having to remit 50% or more of the coupon proceeds to the merchant that actually provides the goods or services. Has Groupon really earned $40 (gross revenue recognition) or $20 (net recording, Groupon’s actual marketing commission).

On Friday, Groupon restated its financial statements to correct the accounting revenue error, and the new financial statements were enlightening. The company’s bottom line for 2008 through 2010 remained unchanged, but top line revenue was reduced to under half the original numbers. This was expected.

But Groupon apparently didn’t want to let go of that much larger gross number, so management found a way to included it in the “Operating Metrics” section of the filing. The company cites “gross billings” and defines that as the amount collected from customers for Groupons sold, net of estimated refunds.

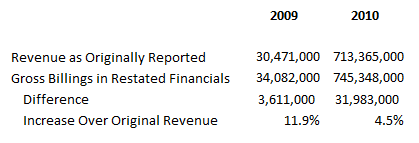

Curiously, the numbers reported for “gross billings” are larger that the original revenue number reported, with no explanation for the discrepancy. As customers purchasing Groupons are required to pay for them immediately, it appears that the original (faulty) revenue figures and the amounts collected from customers (called gross billings) should be nearly identical. They are not:

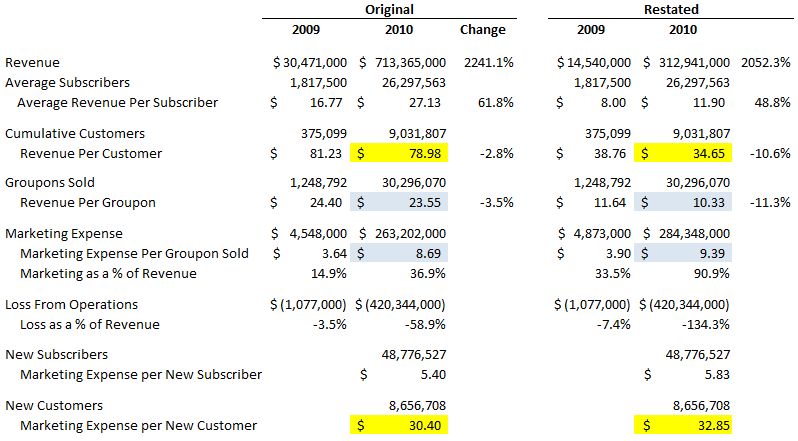

More interesting, however, is how the revenue and expense numbers stack up once the revenue is reported in accordance with GAAP. As you can see below, there are significant changes in many metrics based on the restatement of numbers in accordance with GAAP:

- The average revenue per subscriber and per customer is less than half of what was originally reported

- The year-to-year revenue growth per subscriber and per customer has dropped significantly

- Marketing expenses as a percent of revenue have gone up dramatically, such that marketing expenses in 2010 were almost 91% of revenue.

- The loss from operations as a percent of revenue is dramatically worse

Most notable however, is the dramatically different picture that is painted when we analyze the marketing expenses in light of the restated financials.

First, I compared the marketing expense per Groupon sold to the revenue per Groupon sold (numbers highlighted in blue below). I divided the total restated marketing expense in 2010 by the number of Groupons sold, to arrive at a marketing expense of $9.39 per Groupon sold. This compares to revenue of $10.33 per Groupon sold, based on the restated financials… which means that marketing costs are 90.9% of revenue! Groupon is barely outpacing its marketing costs for each Groupon sold. And there are many other costs in running this business.

Next, I compared the marketing expense per new customer compared to revenue per customer (numbers highlighted in yellow below), since Groupon has stated that new subscribers and new customers are a focus of the company. I divided the restated marketing expense in 2010 by the number of new customers gained in 2010, to arrive at a marketing expense of $32.85 per new customer. Compare that to restated revenue per customer of $34.65, and you realize that the prospects for this business are dim, particularly when almost all of the customers in 2010 were new customers! The company has been spending a ton of money to get new customers, with no promise that the marketing costs will go down or the revenue per customer will go up.

It is clear why Groupon improperly reported revenue prior to being called out by Professor Anthony Catanatch and Professor Edward Ketz. By reporting revenue properly (much smaller revenue numbers!), Groupon’s precarious financial position and operating strategy are exposed. Simply put: The business of Groupon does not work. And I suspect that merchants and consumers are losing interest in the Groupon type of gimmick, which puts even more financial strain on the company.

How will Groupon ever become profitable? It is unclear to me. But what is clear is that the company’s numbers are absolutely awful once the company reports revenue according to GAAP. An analysis of the correct numbers and associated percentages shows a business that is incredibly expensive to run.

Who cares about the massive top-line growth if there is no chance for profitability? It has been terribly expensive to acquire new customers, and there are fewer potential new customers out there. I predict Groupon will spend more and more on marketing, and get less and less in return. And as the numbers show, there is absolutely no room to spend more but get less back.

Anyone want to get in on the Groupon IPO? I sure don’t!

And what about the auditors? Ernst & Young signed off on the 2009 and 2010 financials, with no apparent qualms about the improper revenue recognition. This is noted in a section of the SEC filing called “Experts.” I have written time and again that auditors do not find fraud, and this is a prime example of auditors not finding something that was right in front of their noses. Do not put any faith in the audit report of Ernst & Young.

Tracy, I think that the other important ratio is the marketing % of revenue – which now goes to 90%!! Uh, this cannot be good.

Agree, and that’s the one I’m talking about in the paragraph that starts “First, I compared…”

I have added the ratio to the text so that it’s clear what I”m referring to. Thanks for the comment!

How did the “accounting error” as stated in the 4th paragraph above become “fraud” which you accuse E&Y of not finding? While I am not certain that this was fraud, E&Y certainly did not have a competent team on the ground in performing the audits of these financial statements. As much attention as revenue accounting gets, there is no way that this should have slipped by their team.

Groupon is calling the situation an accounting error. I did not call it fraud. I simply referred to the issue of accountants not finding fraud and a previous article I wrote on the topic. Readers can make their own decisions, I think.

[…] Then issues came up about Groupon’s revenue accounting, which resulted in a restatement. The numbers weren’t pretty. Of course, the numbers were less impressive when top line revenue was chopped in half. And a deeper analysis of the revenue versus marketing expenses was horrifying. Marketing costs were 90.9% of revenue in 2010. And then the numbers were shuffled again, so marketing expense became 92.9% of revenue in 2010. […]

Frequently, in the interest of holding onto a lucrative client, auditors allow these *errors* to be explained away. It isn’t right, it flies in the face of the independence principle, but it happens. A lot.

I just stumbled across this website, Tracy. I’ll be spending quite a bit of my spare time catching up on your prior articles.

[…] have also criticized the high marketing costs and the failure of the Groupon to turn that marketing into profits: First, I compared the marketing expense per Groupon sold to the revenue per Groupon sold (numbers […]

[…] the first problem Groupon has had with its accounting, and it certainly won’t be the last. Groupon’s first set of restated numbers came prior to the IPO, when the SEC told it to fix GAAP violations in the reporting of revenue. Of […]

Heres the deal …..

A) anyone even an idiot can sell tons of anything if hes willing to blow his brains out doing it …..and if the market will let him and continue paying for it.

B)It is impossible for them to make money unless they move to a user generated content model.

C)Retailers/ storeowners are laughing all the way to the bank, they can offer 50 steak dinners at cost and get millions of advertising impressions for their business. Where else on the planet can you break even on your steaks and get millions of impressions……..not. Groupon needs to sell Groupons and charge an impression value for advertising if they want to make money —–if not everyone as a group will loose money invested.

Mark – The anecdotal evidence suggests that merchants are not breaking even. They are generally losing money, and have very low customer retention rates. I have several friends who use Groupon for the cheap deals with no intention of ever revisiting the retailers. I’m afraid that’s more common that Groupon would have us believe.

That makes the situation even worse ….the merchant is not making money …..Groupon is blowing its brains out …..hmmm pretty destructive business model….MISSION IMPOSSIBLE—–loose loose all arround.!!!!!!!!!!!

Well there is one winner: The original owners of the company. They’re cashing out of the business model.

Tracy I agree, it boggles my mind that the market can rally behind something as worthless as this …….what happened to normal business metrics……

I hink I will start selling gaz at 1.50 a gallon and maybe the market will buy me for 1B for my customer base????