Revised Numbers

Some news sites are billing this as a restatement, although it would appear to be more of a revision to the numbers, as the original numbers were simply cited in an earnings release and the financial statements weren’t actually issued until Friday.

Here was the original announcement regarding the fourth quarter of 2011:

- Revenue of $506.5 million, up 194% year-over-year

- Free Cash Flow of $155.1 million, up 258% year-over-year

- Operating Income of $15.0 million, up from $336.1 million loss

- Non-GAAP EPS of negative $0.02, including $0.07 of tax from international operations, up from negative $0.53

- Active customers increase to over 33 million, up over 275% year-over-year

And here is the revised announcement for the fourth quarter of 2011:

- Revenue of $492.2 million, up 186% year-over-year

- Free Cash Flow of $155.1 million, up 258% year-over-year

- Operating Loss of $15.0 million, down from $336.1 million loss

- Non-GAAP EPS of negative $0.06, including $0.06 of tax from international operations, up from negative $0.53

- Active customers increase to over 33 million, up over 275% year-over-year

You can see that the most important figures are revenue (which got reduced by $14.3 million) and operating income (which was reduced by $30 million, and went from a profit to a loss for the quarter).

History of Accounting Problems at Groupon

This isn’t the first problem Groupon has had with its accounting, and it certainly won’t be the last. Groupon’s first set of restated numbers came prior to the IPO, when the SEC told it to fix GAAP violations in the reporting of revenue. Of course, this only happened after the Grumpy Old Accountants pointed out that Groupon was substantially overstating its revenue.

This was also after Groupon was criticized for using the non-GAAP (made up) financial measure of Consolidated Segment Operating Income (CSOI), which asked investors to ignore its massive marketing costs, even though those are closely related (and critical) to its generation of revenue.

Current Accounting Problem

Last year I warned investors about relying on Groupon’s unaudited financial statements. And lo and behold, the first audit after the IPO comes out, and things aren’t looking too rosy for Groupon. In its race to show profits, the company improperly calculated its reserve for customer refunds, meaning the company actually had a loss for the quarter ended December 31, 2011, rather than the profit originally reported to the market.

You can bet there was a serious fight between management and the auditors over this adjustment to the financial statements between Groupon’s announcement of earnings on February 8, and its filing of the 10-K on March 30. If I were a betting woman, I would place a large wager that the auditors wanted an even larger reserve (resulting in even lower net income) and the result we see in the 10-K is some negotiated amount in the middle of where management wanted to be and the auditors thought they should be. (Oh yes… management and the auditors indeed do negotiate on audit adjustments.)

Failure of Internal Controls Over Financial Reporting

A big part of the story here is the failure of Groupon’s internal accounting controls. As a result of the audit work performed by Ernst & Young, management had to report that the company’s internal controls over financial reporting are not effective:

Based on this evaluation, management concluded as of December 31, 2011 that our disclosure controls and procedures were not effective at the reasonable assurance level due to a material weakness in our internal control over financial reporting, which is described below.

In connection with the preparation of our financial statements for the year ended December 31, 2011, we concluded there is a material weakness in the design and operating effectiveness of our internal control over financial reporting as defined in SEC Regulation S-X. A material weakness is a deficiency, or a combination of deficiencies, in internal control over financial reporting such that there is a reasonable possibility that a material misstatement of the annual or interim financial statements will not be prevented or detected on a timely basis. The primary factors contributing to the material weakness, which relates to our financial statement close process, were:

- We did not maintain financial close process and procedures that were adequately designed, documented and executed to support the accurate and timely reporting of our financial results. As a result, we made a number of manual post-close adjustments necessary in order to prepare the financial statements included in this Form 10-K.

- We did not maintain effective controls to provide reasonable assurance that accounts were complete and accurate and agreed to detailed support, and that account reconciliations were properly performed, reviewed and approved. While these activities should be performed in the ordinary course of our preparing our financial statements, we instead needed to undertake significant efforts to complete reconciliations and investigate items identified in those reconciliations during the course of our financial statement audit.

- We did not have adequate policies and procedures in place to ensure the timely, effective review of estimates, assumptions and related reconciliations and analyses, including those related to customer refund reserves. As noted previously, our original estimate disclosed on February 8 of the reserve for customer refunds proved to be inadequate after we performed additional analysis.

With the oversight of senior management and our audit committee, we have begun taking steps and plan to take additional measures to remediate the underlying causes of the material weakness, primarily through the development and implementation of formal policies, improved processes and documented procedures, as well as the hiring of additional finance personnel.

Did I mention that the Grumpy Old Accountants told everyone prior to the IPO to not trust Groupon’s accountants? Specifically, they said:

Finally, there is the issue of adequate internal controls. It is absolutely ludicrous to think that Groupon is anywhere close to having an effective set of internal controls over financial reporting having done 17 acquisitions in a little over a year. When a company expands to 45 countries, grows merchants from 212 to 78,466, and expands its employee base from 37 to 9,625 in only two years, there is little doubt that internal controls are not working somewhere. Any M&A expert will agree. And don’t forget that Groupon admitted to having an inexperienced accounting and reporting staff.

Cash Flow Issues

But the Groupon story gets even better. In June of last year, the Grumpy Old Accountants shined a light on the problems with Groupon’s cash flow. They said it looked like Groupon was overstating its cash from operations, but that there wasn’t enough information provided by the company to know for sure.

At the time of the earnings announcement, the Grumpies told CFO.com more about their suspicions:

[Professor Anthony] Catanach says it is also possible that Groupon is obscuring the quality of its cash flow by providing an aggregate cash-flow statement that lacks many of the details required in 10-Q and 10-K reports filed with the Securities and Exchange Commission. “One of the measures that it keeps touting is its improved free-cash flows and operating cash flows,” says Catanach. But it remains unclear, based on the statement, “where that cash is coming from,” he says. As a result of this omission, the company could be increasing its operating cash flows by stretching out payment terms with its vendors and thus spiking current liabilities, says Catanach. This is a concern because the nature of these liabilities could be crucial information for investors. If Groupon were increasing operating cash flows by slowing payments to merchants, for instance, it could be setting itself up for a fall.

And Groupon’s CFO, Jason Child, called that accusation “silly,” and the article explained:

When it comes to its cash flow, Groupon has a business model that allows it to generate significant cash by paying its vendors about 60 days after it collects from customers. “We do not have inventory, so those payable days provides an operating cycle that produces cash rather than utilizes it,” says Child.

But the company did not increase its cash flow by stretching out payment terms, Child says. Rather, the increase in cash this year came largely from sales growth, he says. “[Catanach] was saying we could be growing our number by not paying our bills. That notion is actually silly,” Child says, because Groupon’s accounts-payable days last quarter were 68, down from 83 in the same quarter the year before. The number is comparable to accounts-payable days at another online commerce company, Amazon.com.

The Grumpies don’t think this issue is so silly:

And then there is Groupon’s Magic Cash Machine! Groupon’s CFO took exception to our criticism about providing only aggregate cash flow data that failed to explain the 234 percent improvement in 2011 OCF. But even he recognizes that “it is pretty unusual to have a business that loses money from a GAAP income perspective, but actually generates free-cash flow.” Sorry Mr. CFO, “pretty unusual” does not hack it…this situation refutes all logic!

One More Issue

But the problems don’t end with the accounting function. Earlier this year I criticized Groupon’s problems with customer loyalty and marketing costs. And I am wondering if there is an even bigger problem in this area, based on changing disclosures.

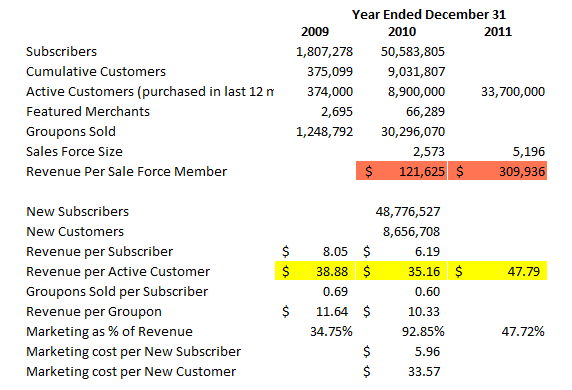

Leading up to the IPO, Groupon disclosed the following important operating metrics: gross billings, subscribers, cumulative customers, featured merchants, Groupons sold, average revenue per subscriber, average cumulative Groupons sold per customer, average revenue per Groupon sold, and cumulative repeat customers. Figures for these important metrics were provided going back to 2008. I did a few additional calculations with those numbers, and voiced some concerns about the business model and the company’s financial results.

I was eager to see how those metrics turned out for 2011, but alas, suddenly those metrics are no longer important. Now the important metrics only include gross billings, active customers, gross billings per average active customer, and revenue per average active customer.

My previous analysis showed troubling figures on a “per Groupon” basis, and magically we have no figures on the number of Groupons sold with which to continue this analysis. I also criticized the numbers on a per new subscriber and per new customer basis, and neither of these figures can be calculated anymore either. Below are the numbers calculated previously, along with the calculations that can be done based on the new disclosures:

And let me point out again a criticism I launched when Groupon was doing its road show. In its slide deck, Groupon touted: “Our Average Customer Spent Over $170 Per Year as of Q3 2011.” The number $170 appeared to be completely fabricated, likely calculated using an incorrect methodology.

The numbers released for December 31, 2011 clearly show that $170 per year spent per customer was a lie. The company released the number of active customers, defined as a customer making a purchase in the last 12 months. In this case, there were 33.7 million customers who made purchases in 2011.

Divide the annual revenue of $1,610,430,000 by the 33.7 million buying customers and you get revenue of less than $48 per active customer. (And lest you should think that Groupon used some other definition of customer in calculating the $170, note that other variations of the calculation would use a larger customer base, thereby decreasing the revenue per customer even more.)

A newly disclose figure that is also suspect, in my eyes, is the revenue per sales force member. Groupon just released sales force figures for the first time. Using the number of sales force members at the end of each year, I calculated revenue per sales force member for the year. In 2010, it calculated to $121,625, and in 2011 it calculated to $309,936.

Are we really to believe that revenue per sales force member increased almost 155% from 2010 to 2011? I simply don’t believe it. While I do believe that greater efficiencies are possible and sales methods may be more successful as the business matures, I do not believe this sort of improvement from one year to the next is possible. There is something more to this part of the story.

Please continue to view all of Groupon’s numbers with the greatest skepticism.