Once upon a time, there was a popular mommy blogger named Jennifer McKinney. She called herself MckMama, and had a blog called My Charming Kids. She was not noteworthy in any way – – until her fourth pregnancy took a turn for the worse. Her unborn son Stellan was determined to have a heart condition, and with pleas for prayer, Jennifer’s popularity skyrocketed.

Once upon a time, there was a popular mommy blogger named Jennifer McKinney. She called herself MckMama, and had a blog called My Charming Kids. She was not noteworthy in any way – – until her fourth pregnancy took a turn for the worse. Her unborn son Stellan was determined to have a heart condition, and with pleas for prayer, Jennifer’s popularity skyrocketed.

The My Charming Kids blog (with McKinney’s “MSC” or “Many Small Children” as the focus) became so popular that at its height, Jennifer was grossing at least $150,000 to $175,000 per year from advertising and money-making gimmicks.

Questions Raised

Not content to post pictures of her kids and stories about everyday life, Jennifer McKinney was determined to live the high life, and pimp out herself, her family, and her blog to maximize her earnings. She appeared to have it all: great kids, a happy marriage, a beautiful house, a luxury vehicle, media opportunities, trips, and much more.

Underneath the façade – – which is covered with flowery language in grammatically challenged sentences – – Jennifer McKinney’s life was an absolute train wreck. Her marriage was falling apart and the family’s finances were in a shambles. McMama and her husband Israel McKinney were shamelessly spending their way around the world while stiffing creditors left and right.

Critical readers (sometimes referred to as naysayers) of the My Charming Kids blog started to take notice, and a tsunami of criticism began. Multiple websites were created to expose the inconsistencies in Jennifer McKinney’s supposed life. Key to the allegations of fraud was an analysis of the medical drama of the McKinney family, who always had sicker kids and more questionable medical situations than normal families seem to encounter. The financial drama seemed incredible as well.

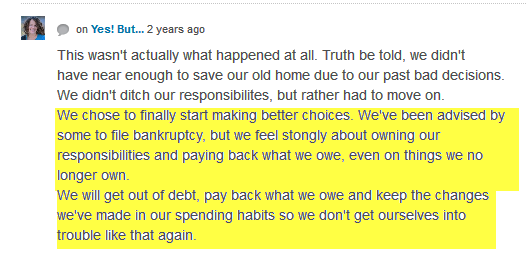

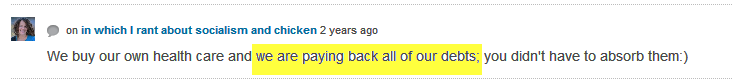

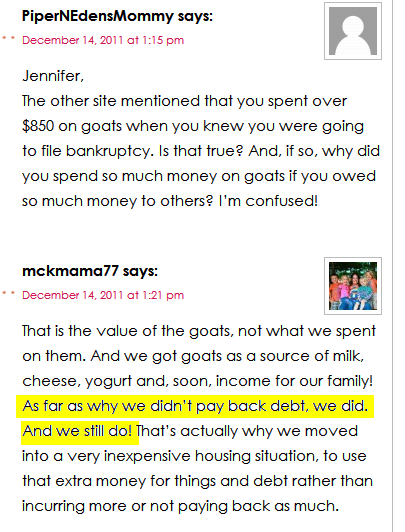

While Jennifer vehemently denies ever lying to her readers, mountains of evidence have been uncovered in support of the allegations of fraud. Here was a family making big money from a home-based business, yet they were losing homes to foreclosure, having vehicles repossessed, and being accused of not paying creditors. Despite repeated claims by Jennifer that the McKinneys were going to pay all their creditors and do better in the future, their spending escalated along with their outstanding debt, to the point where they filed bankruptcy in December 2011.

Bankruptcy Fraud?

Based on the evidence uncovered, it appears that a fraud indeed has occurred… in the United States Bankruptcy Court. Keep in mind the law from the U.S. Code (18 U.S.C. § 152):

A person who—(1) knowingly and fraudulently conceals from a custodian, trustee, marshal, or other officer of the court charged with the control or custody of property, or, in connection with a case under title 11, from creditors or the United States Trustee, any property belonging to the estate of a debtor;(2) knowingly and fraudulently makes a false oath or account in or in relation to any case under title 11;(3) knowingly and fraudulently makes a false declaration, certificate, verification, or statement under penalty of perjury as permitted under section 1746 of title 28, in or in relation to any case under title 11;

Ultimately, fraud must be determined by a trier of fact. In this case, that would be the judge in the Chapter 7 Bankruptcy filing of Jennifer H. McKinney and Israel R. McKinney. However, as a trained fraud investigator, I can recognize red flags of fraud, and that’s exactly what we’re going to look at here: The red flags of fraud in the McKinney bankruptcy filing. (A MckFraud?)

This article is going to discuss the false disclosures and omissions from Jennifer McKinney’s bankruptcy filings and creditors meeting. A huge thank you goes out to the MckMama Without Pity Blog (mckmamatruths.com) which provided all of the transcripts and many of the documents linked below.

As this article is rather lengthy, you can use these links to jump to the relevant sections:

- McKinney’s Financial Train Wreck

- Creditors Meeting

- Undisclosed Blog Income

- More Undisclosed Blog Income

- Undisclosed Income from Amazon.com (and Other Affiliate Programs)

- Misrepresented Blog Income and Undisclosed PayPal Account(s)

- Undisclosed Income from Online Photography Classes

- Undisclosed Assets: Domain Names

- Undisclosed Income in Total

- Undisclosed Camper/RV Sale

- Garage Sale

- On Cheating a Landlord

- Undisclosed Donations and Gifts

- Undisclosed Gift to Family

- Amended Bankruptcy Schedules

- Opinions

McKinney’s Financial Train Wreck

The financial backstory goes like this: Israel had an allegedly successful business in the construction industry called Kieran’s Contracting. When the economy tanked, the business failed. While Jennifer raked in gobs of money with her blog (and had relatively minimal business expenses as a home-based blogger), Jennifer and Israel spent beyond their means and found themselves in a financial pit.

A handy-dandy timeline of the financial meltdown can be found here. In summary, the McKinneys lost three houses, had a Cadillac Escalade and a Dodge Ram repossessed, were sued by a former employee for more than $55,000 of unpaid compensation and reimbursable expenses, had an IRS tax lien of $52,207 filed for 2006 and 2007 taxes, lost a lucrative advertising contract with BlogHer that brought in the bulk of the blog money due to plagiarism, ran up substantial hospital bills with irresponsible use of emergency rooms around the country, had an IRS tax lien of $35,763 filed for 2008 and 2009 taxes, and ultimately filed bankruptcy.

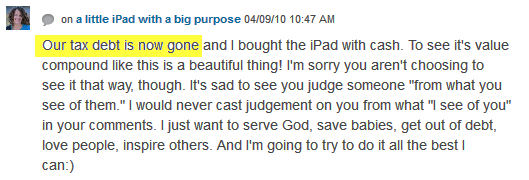

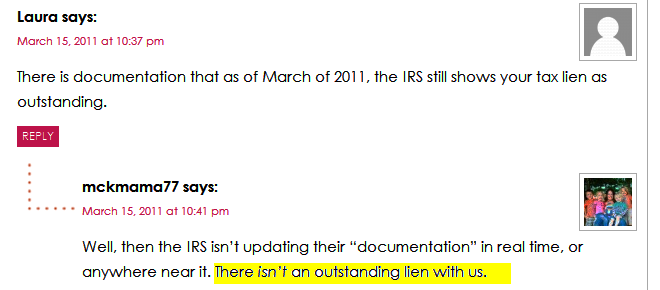

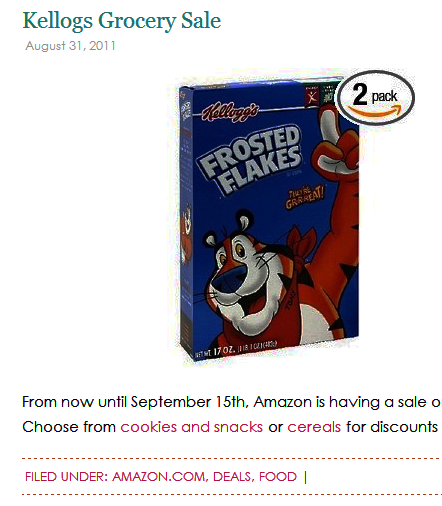

The easiest lies to prove are the ones about the back taxes owed by the McKinneys. On multiple occasions, Jennifer McKinney falsely stated to the McMama readers that there were no tax liens. As far back as two years ago, Jen McKinney was claiming their taxes were paid off:

This is despite the fact that the 2006 and 2007 tax lien for $52,207 was filed in April 2009, and the later tax lien of $35,563 for 2008 and 2009 was filed in July 2011. Surely the McKinneys knew they hadn’t paid those taxes, and that at least one lien existed when the comments were made (and they likely knew that the second lien was coming).

How do we know these were valid liens, still outstanding at the time Jennifer made her declaration that the taxes were paid off? The bankruptcy petition included tax liabilities of $28,148 for 2007-2009 federal income taxes, $4,556 for 2009 Minnesota income taxes, $82,365 for 2006 federal income taxes. This totals $115,069 in unpaid income taxes, directly contradicting Jennifer’s multiple claims that the tax debts were paid off or being paid.

Bankruptcy Filing Problems

While normal consumers might use the bankruptcy process as a chance to reexamine their lives and priorities, and have a fresh start, Israel and Jennifer McKinney appear to have decided to take a different approach. The bankruptcy filing in the District of Minnesota (Case No. 11-61215) is full of false and misleading disclosures, including failure to disclose valuable assets to the bankruptcy trustee.

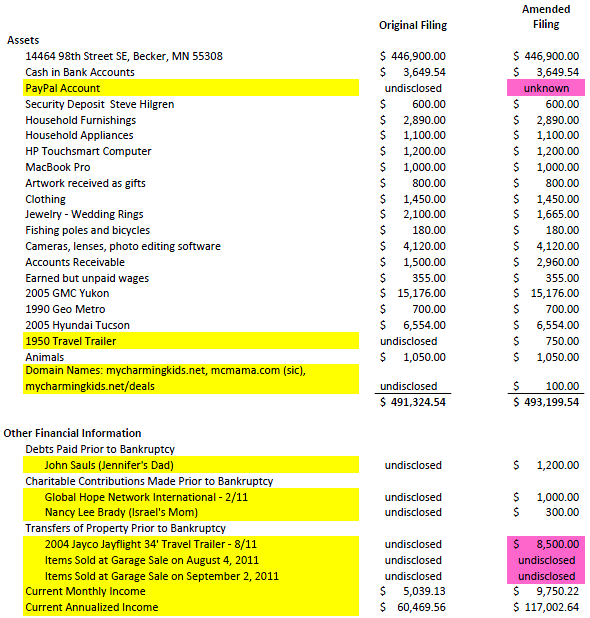

The bankruptcy of Jennifer Howe Sauls McKinney and Israel McKinney was originally filed on December 12, 2011. In this filing, they disclosed assets of $491,325 and liabilities of $725,483. A summary of the assets and liabilities can be seen here.

A creditors meeting in the bankruptcy of Israel and Jennifer McKinney was held on March 5, 2012. Complete transcripts can be found here. Certain omissions in the December 2012 bankruptcy filing were immediately pointed out by the Trustee. And Jennifer proceeded to try to wordsmith herself out of the problems, to no avail. In no particular order, we will look at relevant portions of the transcript and other documentation that tend to prove the falsity of the bankruptcy petition and oral representations of Jennifer and Israel McKinney.

TRUSTEE: So you filed bankruptcy, you’re still doing Google AdSense, right?

JENNIFER: Mm-hmm.

TRUSTEE: So you suddenly start doing all these other ads, too? Right after you filed bankruptcy?

JENNIFER: No I’m not doing them anymore.

TRUSTEE: Okay. Why’d you stop?

JENNIFER: Because I had got a relationship with the bigger ad networks that were more lucrative than small people’s ads, always kind of having those up. I still do them from time to time, like twice a year to promote, like, my readers’ Etsy sites, their small business, ’cause they—so I sometimes do that. But for the most part my income is from my ad network, straight up.

TRUSTEE: Let’s talk about your Google AdSense account. I’ve looked at that and there’s page views and clicks and things of that nature.

JENNIFER: Mm-hmm.

TRUSTEE: Why is it that for the month of December there’s less than, at the very most, 35 page clicks on any one day.

JENNIFER: Because I believe in December I had switched from Google AdSense to Burst, my fourth or so ad network, hoping they would be more lucrative for me, so I shut off my Google Ads and they only fill when Burst runs out, so maybe by the end of each day Burst has shown as much as they’re allowed to and then it will automatically go to Google.

TRUSTEE: So then why on, say, February 1st, for example, you went to 24,354 clicks on Google AdSense?

JENNIFER: Because Burst, after staying with them for about a month and a half, I only made like $700, when I had been making like $1,500 or so with Google Ads, so I decided to turn those off and go back to Google. It’s kind of a balance of finding how I can get paid the most.

TRUSTEE: So why did you switch to Burst? What did they offer you to move with them?

JENNIFER: Um, no one offers you anything in this industry, any certain promise. They can sort of say “we have a lot of good relationships, blah, blah, blah.” I had a friend in the industry who recommended them and said he thought they could be good for my page views, so I just thought I would try, and they didn’t promise me anything except to fill my blog as best they could. It just wasn’t as good as Google so I went back.

TRUSTEE: So when did you switch to Burst?

JENNIFER: I don’t remember exactly but I’m assuming if you saw that in December, maybe it was December? I can look it up.

TRUSTEE: I remember going farther back in your logs and seeing like in June or July that your Google went down to less than 30 clicks.

JENNIFER: Right. That was probably, sir, when I switched to Say. We talked a lot about Say last time. I was with them and they were quite lucrative for me until I was no longer able to be with them.

TRUSTEE: Why weren’t you able to stay with Say anymore?

JENNIFER: They were the ones that BlogFrog worked with and BlogFrog itself decided that it wasn’t lucrative enough for them to stay with, so they couldn’t serve it to me any longer.

Okay, I was with Say through November, had Google Ads up for a little bit in the interim, added Burst in the middle of December, and then took them down again relatively recently and put Google back up.

TRUSTEE: Did you switch providers in anticipation of filing your Chapter 7 bankruptcy?

JENNIFER: No, not at all. I’ve been trying to make the most money I can to not have to file, but now I’m just trying to make the most money I can to support our family.[snip] TRUSTEE: Alright. Who’s getting paid from New Media Consultants in December 2011? Is that you, ma’am?

JENNIFER: Mm-hmm.

TRUSTEE: What’s that for?

JENNIFER: That’s just more blog income—ads on my blog.

TRUSTEE: So you got paid $500 at that point in time. When was that money earned?

JENNIFER: When did I get that paycheck?

TRUSTEE: December 23rd.[snip] TRUSTEE: So in December of 2000 [sic] I’ve got a report here from Burst Media, December of 2011, that shows income of $824.26.

JENNIFER: Yes sir.

TRUSTEE: And just for my recollection, you started Burst again when?

JENNIFER: I started Burst mid-December.

TRUSTEE: Okay. From Google AdSense?

JENNIFER: Exactly.

TRUSTEE: Okay. So then that mid-December, half a month you made $824 from Burst, right?[snip] MCKINNEY’S ATTORNEY: I do have two checks deposited somewhere around December 6th.

TRUSTEE: Okay.

MCKINNEY’S ATTORNEY: Added together come up to about 6387. I think that’s that number you were looking for there, and they were both from BlogFrog.

TRUSTEE: Okay, so it’s—it came up to 62, you said?

MCKINNEY’S ATTORNEY: Uh, 6387.

TRUSTEE: That sounds right.

MCKINNEY’S ATTORNEY: Is what I’m looking at, and then there might be, you know, something else that adds to that, maybe there was a third check somewhere.

JENNIFER: It would have been another $500 check then, to make 68.

MCKINNEY’S ATTORNEY: Right, so . . .

TRUSTEE: Okay, so BlogFrog paid you approximately $6,300 in December of 2011?

JENNIFER: Looks like they did.

TRUSTEE: And maybe we’ve covered this before, but you’ve got Say, you’ve got Burst and you’ve got BlogFrog–

JENNIFER: Say and BlogFrog

MCKINNEY’S ATTORNEY: Are the same.

JENNIFER: Were the same.

TRUSTEE: Okay. So—and you didn’t make . . . and BlogFrog discontinued doing business with you in December?

JENNIFER: With Say.

TRUSTEE: With Say. But they’re still doing business with you now?

JENNIFER: Yeah but it’s like I don’t really get anything because they’re not with Say, but technically we’re affiliated.

TRUSTEE: But you’re with Burst, aren’t you?

JENNIFER: Now I’m back with Google.

TRUSTEE: Okay. You were always with Google though, right?

JENNIFER: Nope. When I’m with someone else I’m not with Google at all, except maybe a tiny spillover. It’s . . .

So Jennifer claims she was making $1,500 per month with Google, which would appear to correlate with the monthly income she reported in the bankruptcy filing. But the trustee finds her actual income in the documents. The real income received in December 2011 was:

- $500 from New Media Consultants

- $824 from Burst

- $6,387 from BlogFrog and another $500 from an unknown source

- Undisclosed income from Amazon.com and other affiliate programs

- Potentially other undisclosed income

This is a total of at least $7,711 in December 2011 alone, when Jennifer reported in the December 2011 bankruptcy filing that her total income (blog, photography, deals, the whole works) was going to be $1,500 per month. A simple peek at her own accounts would have clearly told her that her income was going to be more than $1,500 per month.

TRUSTEE: So you had all this money sitting in your PayPal account then before you filed bankruptcy, right?

JENNIFER: I guess so.

TRUSTEE: Alright, here’s some bank transactions. This is the Wells Fargo account, this is the photography account. On 11/4/2011 you deposited in a branch store $3,497.23. Do you know what that’s from? That’s a little over a month before you filed bankruptcy?

JENNIFER: For 2,000?

TRUSTEE: 2011.

JENNIFER: Dollars? I can look it up.

TRUSTEE: $3,497.

JENNIFER: $3,400. Could you tell me that date one more time?

TRUSTEE: November 4th.

JENNIFER: I’m guessing it was for Say Media, but . . . $3,000?

TRUSTEE: $497.22

JENNIFER: [shuffling papers] Well it must have been a combined, a couple of checks combined because I’m not seeing one for exactly that amount, but . . .

TRUSTEE: How many deposits do you have on November 4th? It looks like two deposits, one for $365 that’s from PayPal and then this deposit made in the branch store.

JENNIFER: Here’s one on the 6th but it’s for even more . . . how many deposits on which day, sir?

TRUSTEE: November 4th, one for $365, one for $3,497

JENNIFER: Into which account did that go into?

TRUSTEE: Your photography account, #9246.

JENNIFER: It’s supposed to be every single check that I deposited.

MCKINNEY’S ATTORNEY: Oh, these are 7469; these are the other account. This is the wrong account. You’re looking for 9246.

JENNIFER: Okay.

MCKINNEY’S ATTORNEY: I’m not seeing 9246.

JENNIFER: Then they didn’t print them. But I would feel certain that has to be—I just put my Say check into that but sir, I don’t know for sure.

TRUSTEE: Okay well then last time we talked there was a check deposited on December 6, 2011, $6.087.81. You told me that was the last Say check. So you made $9,000 from Say in the roughly two month period of time before you filed bankruptcy?

JENNIFER: Probably not. Could you tell me those two dates and amounts again?

TRUSTEE: December 6, 2011, $6,087.81 and on 11/4/2011, $3,497.23.

JENNIFER: I’m certain that the November one must have been Say and then the December one was probably Say, plus I probably got something else and it probably—another $3,000? It won’t be in there because that’s not it.

MCKINNEY’S ATTORNEY: Those numbers aren’t there.

TRUSTEE: What other income did you have coming in from other entities?

JENNIFER: My dad gave us a whole bunch of money but that was at Christmas.

TRUSTEE: From where?

JENNIFER: At Christmas. My dad, but that wouldn’t have been . . .

TRUSTEE: I only saw your dad putting money in your PayPal account though, right?

JENNIFER: A couple of times. When he gives me money that’s sometimes where he puts it. That’s more recently.

TRUSTEE: So he’s writing you checks in addition to PayPal?

JENNIFER: Christmas check; he gave us a Christmas check.

TRUSTEE: You filed bankruptcy on December 12th.

JENNIFER: So I had just put $6,800 a few days earlier. Okay, well I guess I just . . .

TRUSTEE: You don’t know where that money came from?

JENNIFER: Well not exactly. Probably it was a Say check and then a bunch of other.

TRUSTEE: What records would you have to have to look at?

JENNIFER: I would probably have to get, just like I did with these, get the copy of the checks that I deposited, so that I would know what it was.

TRUSTEE: Have you set up a meeting yet with your accountant yet for tax purposes?

JENNIFER: No. We don’t have anything scheduled.

TRUSTEE: Do you plan on filing your 2011 taxes in a timely fashion?

JENNIFER: Yes I do.

One bank deposit of $3,497 in November 2011 alone again shows the falsity of Jennifer’s statement that she was going to make $1,500 per month.

Undisclosed Income from Amazon.com (and Other Affiliate Programs!)

TRUSTEE: And this deals, is that where you sell things for other retailers? Through that?

[snip]

JENNIFER: I share deals, right. Yep.

TRUSTEE: And then you get kickbacks from manufacturers or retailers?

JENNIFER: Yes, through Amazon.

TRUSTEE: How do you get paid by Amazon?

JENNIFER: PayPal.

TRUSTEE: You get merchant credits?

JENNIFER: I don’t know what that is.

TRUSTEE: So merchants put a credit on your account, like Amazon, for example. They give you a credit for deals that come through your site so that you have, let’s just say $100 of things you can buy at Amazon.

JENNIFER: Oh. Maybe they offer it. I just take it as a straight up payment to PayPal.

TRUSTEE: So at the time that you filed bankruptcy on December 13th you did not have any credits with any manufacturer, any retailer, anybody that you’re selling stuff for through your site or partnering with? Is that right?

JENNIFER: No. The deals is pretty new, I still haven’t even really—I don’t think I’ve even gotten paid through Amazon. It’s sort of theoretical still.

TRUSTEE: Prior to that bankruptcy did you have any—for example I’ve seen your blog and I’ve seen where you refer people to buy camera equipment and things like that.

JENNIFER: Mm-hmm.

TRUSTEE: Now do you get a percentage or some sort of cut on the sale of that if somebody buys something, don’t you?

JENNIFER: Not until I got the deals page affiliate. You’re not allowed to use affiliate links on a blog unless you disclose them, so on my main blog page anything that I promote I am just sharing and I am not allowed to get a cut.

TRUSTEE: So you haven’t gotten any cuts on anything that’s been sold or that referred to your website or web pages?

JENNIFER: Before I filed?

TRUSTEE: Before you filed.

JENNIFER: Not through Amazon. I mean, let’s see . . . when my deals page first started I had a relationship, and I still do, with a coffee ministry, and my deals girls helped me promote that, and I did disclose that I got a cut and I was paid. That was not before I filed however, sorry, so I don’t know why I brought that up. I got like $150.

TRUSTEE: So all these referrals, if you will, or links to camera equipment and things of that nature on your blog or website, you have never received any credits or money paid to you prior to the time that you filed bankruptcy?

JENNIFER: I do not believe so.

TRUSTEE: Well you would know if you did, wouldn’t you?

JENNIFER: I don’t remember the exact—I may have gotten a small cut back from Amazon when we first started it, but I really don’t remember.

TRUSTEE: I thought you said you didn’t start that until after you filed bankruptcy.

JENNIFER: Right. I just don’t—maybe I started it like two days before. It was around Christmastime, I remember that.JENNIFER: December 23rd. You know what that was? That was probably my very first payment from the Amazon affiliates that we started in the middle of December sometime. Possibly, very certainly, I probably had funds coming, I just didn’t know how much they were yet, and I should have listed those, and then when those paid out they paid me, so that should have been listed as accounts receivable, I guess that’s called.

TRUSTEE: So even though it doesn’t say Amazon it’s from Amazon?

JENNIFER: It is. Those are the deals gals that manage it for me.

TRUSTEE: What does that mean?

JENNIFER: Um, I don’t take care of putting the Amazon links on my blog and looking for deals.

TRUSTEE: Who does?

JENNIFER: A friend of mine.

TRUSTEE: Who’s that?

JENNIFER: Alli Worthington.

TRUSTEE: Is she an employee of yours?

JENNIFER: No.

TRUSTEE: She’s not the person that you claim you pay every month to—

JENNIFER: No.

TRUSTEE: And who does she work for?

JENNIFER: Herself.

TRUSTEE: And she obtains ads for your blog?

JENNIFER: No, she manages the affiliate links on the deals page.

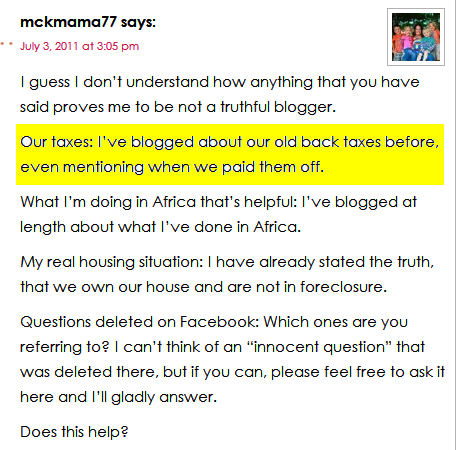

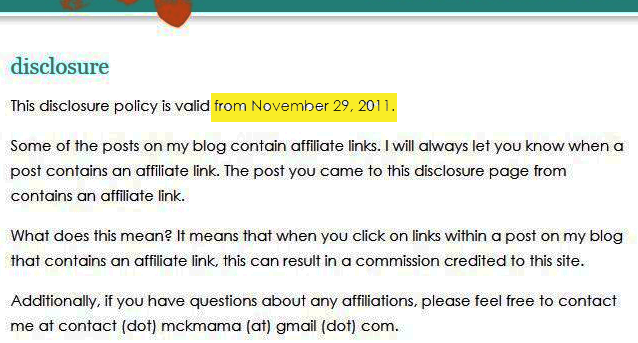

The information provided here is incomplete and false. Jennifer began offering her “Deals” portion of the site in March 2011, as shown here. Not only does she receive income from Amazon.com, she also receives income from Groupon, Logical Media, Eversave, Commission Junction, Doubleclick, and likely other affiliate programs. And what about the possibility that Jennifer meant that only the Amazon deals started in December 2011? Below is just one deal from August 2011 that has an Amazon link and is clearly tagged as “amazon.com.”

And Jenni’s affiliate disclosure, which is dated November 29, 2011, is clearly not “two days” before the filing of the bankruptcy:

It is obvious that the deals did NOT start around Christmas 2011 as Jennifer represented to the bankruptcy. Not even close.

Further, Amazon pays its affiliates monthly, with deposits directly to a bank account, with an Amazon.com gift card, or a check. So it is clear that Jennifer’s first payment from Amazon would not have come in December 2011, around the time of the bankruptcy. It would have come several months before.

Misrepresented Blog Income and Undisclosed PayPal Account(s)

TRUSTEE: I looked at your Google AdSense account.

JENNIFER: Mm-hmm.

TRUSTEE: You had $2,060.16 owed at the end of November, not paid until December 23rd. So you issued a check to yourself on November 23rd? I know you don’t have that documentation with you, but you only listed, I think, $1,500 for accounts receivable in your bankruptcy schedules. Do you recall that?

JENNIFER: I do.

TRUSTEE: And yet you had over $2,000 just owed to you by Google AdSense. Do you recall that?

JENNIFER: Yes. Well I do now. I usually get about 15 whenever I have them for a full month, so I think I was assuming that’s how much I had. I should have just checked to see.

TRUSTEE: You didn’t bother checking your AdSense balance?

JENNIFER: Gosh, I guess I must not have. Or maybe that month hadn’t finished? I don’t know.

What were the dates of that again? That I had earned that?

ISRAEL: September 1st through October 18th.

JENNIFER: No, no, the one he just said, of the . . .

TRUSTEE: November. Balance at the end of November. Let me show you a printout of that amount. Do you see where it says balance at the end of November?

JENNIFER: Yes.

TRUSTEE: $2,060 and some cents?

JENNIFER: Yep

TRUSTEE: You can cash that out any point in time after that, can’t you?

JENNIFER: Yeah. I can’t get the money instantly but I can’t have the money, start working on—

TRUSTEE: Well how long does it take, a day?

JENNIFER: No, no, it takes a month. Usually you don’t get it ’til a month after the month ends. But yes I could have looked and seen how much I would have coming the next month and I apparently didn’t and rounded to 15, instead of writing 2,000.

TRUSTEE: Where does it say that you can’t cash that _____ in? {48:59}

JENNIFER: Um, it doesn’t say anywhere, that’s just—I mean on the website, I suppose. It’s not like you can just . . .

ISRAEL: That’s their payment schedule.

JENNIFER: That’s their payment schedule, yeah. You get paid after a month after that month ends.

TRUSTEE: So in December of 2000 [sic] I’ve got a report here from Burst Media, December of 2011, that shows income of $824.26.

JENNIFER: Yes sir.

TRUSTEE: And just for my recollection, you started Burst again when?

JENNIFER: I started Burst mid-December.

TRUSTEE: Okay. From Google AdSense?

JENNIFER: Exactly.

TRUSTEE: Okay. So then that mid-December, half a month you made $824 from Burst, right?

JENNIFER: Was it just half a month? I thought that I made about 700-800 after I had been with them for a whole month.

TRUSTEE: Let me show you this chart. It looks like you also were with them November of 2011.

JENNIFER: For, I think, a day, so maybe I . . . okay, okay, you know what? This isn’t right, then. I remember this. I was at the very end of the month, maybe one day. I made $30 because once I joined them I stayed, so then all of December I made $824.26. That led me to decide it wasn’t worth staying with them.

TRUSTEE: So then you had some income that you’d earned from Burst at the time you filed bankruptcy also?

JENNIFER: I guess, yes. I would have had 13 days, so maybe $300-some.

TRUSTEE: So you have the Burst income, you’ve got the Google AdSense, you have the media consultants, you have the PayPal account. You don’t list any of those things in your bankruptcy schedules, right?

JENNIFER: I didn’t separate them out and I didn’t list as much as I had coming in, no.

TRUSTEE: Well you have a PayPal account, a bank account, with money in it, right?

JENNIFER: Yes.

TRUSTEE: Money that you can put in and take out?

JENNIFER: Right, but everything from the PayPal goes right to my bank account, so I didn’t list it because it’s not—it’s effectively just a door into my bank account. For the money on here I listed, it would have been from my bank account.

TRUSTEE: That’s not what the question asked. The question asked you to list all bank accounts, doesn’t it?

JENNIFER: Yeah, I didn’t list my PayPal account. I didn’t think of it as a bank account. I’m sorry.

So Jen earned $2,884 of income from certain advertising alone in December 2011, yet in that same month, she put on her bankruptcy paperwork that she was going to earn $1,500 per month total from the website, photography, and deals. Liar, liar, pants on fire.

And she didn’t think that she had to list a PayPal account? Well, not account. Accounts. Because to date, it appears that at least four PayPal accounts are registered to Jennifer McKinney:

- One registered to [email protected]

- One registered to [email protected]

- One registered to [email protected]

- One registered to [email protected]

Apparently #1 is the one through which most of her income, including photography and blog revenue goes. I wonder when Jennifer was planning on telling the bankruptcy trustee that there was more than one PayPal account?

Undisclosed Income from Online Photography Classes

TRUSTEE: Okay.

The, um, Mrs. McKinney, are you doing these photoshoots again?

JENNIFER: I have not.

TRUSTEE: I think I read on your website recently that they’re all filled up for the next—

JENNIFER: Photo classes, sorry. Photoshoots I’m not doing.

TRUSTEE: Okay.

JENNIFER: Online photo classes.

TRUSTEE: Alright. You stopped doing that prior to filing bankruptcy?

JENNIFER: I hadn’t offered those before. This is new. I had done photoshoots. That was in person, taking pictures of people’s families. Photo classes are different.[snip] TRUSTEE: Now you filed bankruptcy on December 13th. In my notes here it says that you had a number of these photography workshops in 2011, as late as December 5th. It’s your testimony that you didn’t have any of these photography workshops?

JENNIFER: If I said that I did then I _____ that I did. Workshops in person, and that was also a second thing that I did, a couple of those, in Texas.

TRUSTEE: So you did in person workshops where you drove around the country and then you had—you also had workshops online or via telephone conference?

JENNIFER: Yeah, those are new. The driving around was around this winter.

TRUSTEE: You did online photography workshops prior to your bankruptcy filing, didn’t you?

JENNIFER: I don’t think so.

Yes, MckMama did hold online photography prior to the filing of the bankruptcy. Lots of them.

She started with face-to-face workshops in September 2011, with a cost of $250 per person for a 1/2 day, or $400 for the whole day. There were 14 attendees for the morning Dallas workshop alone, which would mean income of about $3,500 for the morning, and around $5,000 or $5,500 for the whole day.

On September 30, 2011, Jennifer McKinney announced she was starting online photography classes. She advertised 6 classes for October 2011. With 10 participants per class, and a fee of $40 per person, that’s $2,400 in revenue. She also offered hourly one-on-one help for $50 per hour.

Undisclosed Assets: Domain Names

TRUSTEE: I’ve had you provide me with various documentation, things of that nature. I have some questions for you regarding that. First is, is ma’am, we have a domain name contract for JenniferMcKinneyPhotography.com. Is that accurate?

JENNIFER: Yes.

TRUSTEE: And you didn’t list that in your bankruptcy petition. Is that correct?

JENNIFER: It is no longer a current domain that I own.

TRUSTEE: Okay. Did you let it lapse or what?

JENNIFER: Yes, I just didn’t renew it the last time it expired because I don’t use it anymore.

TRUSTEE: So you don’t plan on renewing it, then?

JENNIFER: I don’t plan on it.

TRUSTEE: And was that lapsed when you filed your bankruptcy on December 13th?

JENNIFER: Um, that’s a good question. I’m quite certain it had not lapsed then.

TRUSTEE: Then why didn’t you list it on your schedules?

JENNIFER: I didn’t even think of it. List it as a?

TRUSTEE: Well is it an asset? Is it something that had value?

JENNIFER: Uh, no.

TRUSTEE: What about MyCharmingKids.net?

JENNIFER: Yes. Those are very different.

TRUSTEE: Okay, let’s talk about MyCharmingKids.net.

JENNIFER: Okay.

TRUSTEE: That’s your _____, right? {01:47}

JENNIFER: Yes.

TRUSTEE: That’s for a blog that you write?

JENNIFER: Yes.

TRUSTEE: Alright. And does that have any value?

JENNIFER: The blog itself? The actual domain name?

TRUSTEE: The domain name.

JENNIFER: I don’t know. Usually domains cost $10 a year, that’s how much I paid for that one.

TRUSTEE: But your domain name, there’s a lot of people that follow your blog, correct?

JENNIFER: Yes, correct.

TRUSTEE: And they identify it with that domain name, don’t they?

JENNIFER: Right.

TRUSTEE: So it has value?

JENNIFER: I guess. I had never thought about it that way.

TRUSTEE: Okay. And did you—has that been renewed by you?

JENNIFER: Yes.

TRUSTEE: When?

JENNIFER: Um. About three or four months ago I remember that one coming up for renewal.

TRUSTEE: What did you pay to renew it?

JENNIFER: It’s $10 a month for me—a year, I’m sorry—to host it through, um, Google.

TRUSTEE: And you have another blog by the name of MckMama.com?

JENNIFER: That is the same. It is a URL that I bought that redirects to MyCharmingKids.net.

TRUSTEE: So what did you pay for MckMama.com?

JENNIFER: Gosh; that one’s either $5 or $10 a year, also through Google.

TRUSTEE: So you pay it or you pay to use it? You said you bought it, I thought you said.

JENNIFER: Yes, you buy the domain, so I own MckMama.com. I bought it through Google and I must continue to pay $10 a year for it to continue to be mine.

TRUSTEE: Okay, so how much value does that have?

JENNIFER: Probably . . . I mean, $10.

TRUSTEE: So you don’t mind then if I try to sell those domain names and pay you $10?

JENNIFER: Well I wouldn’t sell them for $10.

TRUSTEE: What would you sell them for?

JENNIFER: Gosh, I wouldn’t . . . I would probably never sell them.

TRUSTEE: It’s not a question of what you’d sell them for, it’s what value they have. It’s part of your bankruptcy schedules.

JENNIFER: Um. I would, uh . . . that’s a great question. I would probably sell it for, like, $50 and I would just buy a different one and then, you know, I would be able to figure something else out.

TRUSTEE: Alright, so then you wouldn’t have an objection if I tried advertising this for sale, MckMama.com and MyCharmingKids.net?

JENNIFER: Well I would have a problem with it since it’s not yours to list for sale.

TRUSTEE: It is mine. It’s the bankruptcy estate’s. You didn’t list it

JENNIFER: Oh, got it. I see what you’re saying.

TRUSTEE: It’s an undisclosed asset.

JENNIFER: Okay. No, I would figure something out. I mean, I would be able to survive without it.

TRUSTEE: Okay, so I’ll put that on the list of sort of things that we plan to sell.

What’s interesting about the domain names, is that Jennifer would have us believe that they are worth $100, as shown on the amended bankruptcy schedules. She has an interest in lowballing that, and she claimed in the creditors meeting that the value was the $10 annual fee she pays for the domain name. The fact is, the actual asset is the domain name plus the blog. And as we have seen, that asset is very valuable.

TRUSTEE: Alright, total PayPal income from 2011 was $67,086. Now that would have been from the photography stuff you did, right?

JENNIFER: I’m sorry, I didn’t hear—I wasn’t listening.

TRUSTEE: PayPal income for 2011, $67,086, alright?

JENNIFER: Yep.

TRUSTEE: And that would have come from photoshoots?

JENNIFER: Yep.

TRUSTEE: What else?

JENNIFER: Online classes, in person classes.

TRUSTEE: Anything else.

JENNIFER: Weddings, um, anywhere else I would have gotten money, you mean?

TRUSTEE: Where else would that $67,000 originate?

JENNIFER: You know, my dad would give us gifts through PayPal.

TRUSTEE: I saw those; they’re fairly small, aren’t they?

JENNIFER: Exactly. And then sometimes I would sell things on eBay or people would pay me—very minimal. For the most part that’s all photography or blog income.

TRUSTEE: Alright. Google AdSense revenue 2011, $21,303—that’s self explanatory?

JENNIFER: Yep.

TRUSTEE: That was all through clicks on your website, correct?

JENNIFER: Yep. Indeed.

TRUSTEE: Deposits in branch bank, $59,736. That’s what you’ve got there?

JENNIFER: Yep.

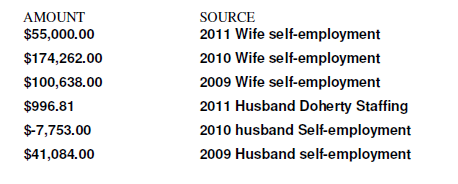

Jennifer and Israel McKinney disclosed that 2011 income from Jennifer’s business was $55,000, in both the original filing and the amended filing. This is patently untrue. The income the trustee found included:

PayPal – $67,086

Google AdSense – $21,303

Deposits at Bank Branch – $59,736

TOTAL – $148,125

Note that this does not include income Jennifer received from Amazon.com and other affiliate programs (from which she likely has been receiving monthly payments since at least April 2011, but for which Jennifer claimed in the creditors meeting that she has received nothing).

The total of $148,125 in 2011 is obviously a far cry from the $55,000 income for 2011 that Jennifer is still claiming in the amended bankruptcy schedules:

Undisclosed Camper / RV Sale

TRUSTEE: Last time we talked about the camper and you testified, that I recall, that there was one camper that you were renting from a neighbor. Is that right?

JENNIFER: Yes.

TRUSTEE: Did you ever own a second camper?

JENNIFER: No.

TRUSTEE: And there was a camper—did you sell a camper on Craigslist?

JENNIFER: We never had owned it.

TRUSTEE: You sold a camper on Craigslist that you didn’t own?

JENNIFER: Mm-hmm.

TRUSTEE: How would you sell a camper on Craigslist you didn’t own? What authority did you have?

ISRAEL: What’s the question?

TRUSTEE: What authority did you have to sell a camper on Craigslist that you didn’t own?

ISRAEL: Um, I believe we never titled it, the camper, in our name; therefore it was never ours.

TRUSTEE: This isn’t a game of semantics. Did you own it, even though it wasn’t titled in your name? Did you pay for it?

ISRAEL: Uh, I was advised that if we did not title it in our name, we never owned it.

TRUSTEE: Who paid—who advised you of that?

ISRAEL: Um, I think that we got that advice at this meeting last time from our counsel.

TRUSTEE: Alright. Did you pay for it?

ISRAEL: Uh, I didn’t because I wasn’t working but yes, we together paid for it. My wife wrote the check.

TRUSTEE: Alright. We can be here a long time. In fact if we don’t get any straight answers we’re going to be here a long time.

Now last time I asked you about the camper you said you never owned it, ma’am, and that’s because it wasn’t titled in your name?

JENNIFER: Correct.

TRUSTEE: What kind of camper was it?

ISRAEL: Jayco Jayflight.

TRUSTEE: What year?

ISRAEL: Um, not certain. Do you remember.

JENNIFER: Mm-mm [no].

TRUSTEE: How many feet was it?

ISRAEL: 34 I believe.

TRUSTEE: Slide?

ISRAEL: One slide, yes?

TRUSTEE: Travel trailer, or uh—

ISRAEL: Travel trailer.

TRUSTEE: What’d you pay for it?

ISRAEL: Do you remember?

JENNIFER: 12?

TRUSTEE: 12,000?

JENNIFER: I think 12,000

TRUSTEE: Did you pay cash?

ISRAEL: Cash or check?

JENNIFER: No, I think I paid him through PayPal?

ISRAEL: Yeah, you did.

TRUSTEE: Who’d you buy it from?

ISRAEL: A man in Madison, Wisconsin.

TRUSTEE: Did you find it on Craigslist, or somebody you knew?

JENNIFER: We found it on some online thing, I think Craigslist.

TRUSTEE: Alright, so you bought it. What year did you buy it?

JENNIFER: We bought it on the way home from our first trip.

ISRAEL: Yeah, 2011

TRUSTEE: January?

JENNIFER: You said what year.

ISRAEL: Uh, it would have been March, I believe?

TRUSTEE: Alright, so you bought it in three of 2011, you paid $12,000 for it, you paid for it through PayPal. When did you sell it—what month?

JENNIFER: It wasn’t long after we got back.

ISRAEL: June? May?

JENNIFER: Probably May or June.

ISRAEL: May? I believe it was late May.

TRUSTEE: May of 2011?

ISRAEL: Yes.

TRUSTEE: What’d you sell it for?

ISRAEL: What did you sell it for, 85?

JENNIFER: No, I think it was like 90

ISRAEL: You listed it for 10

JENNIFER: I think I sold it for $9,000.

TRUSTEE: Alright.

JENNIFER: And I think that deposit was on my bank statement.

TRUSTEE: So you sold it for $9,000. Alright.

JENNIFER: Yep.

TRUSTEE: Okay.

ISRAEL: I think it was 85; they talked you down an extra 500.

JENNIFER: Oh yeah, I think you might be right.

TRUSTEE: Who bought it?

ISRAEL: A couple on Craigslist from South Metro.

TRUSTEE: Okay. No one any relation to you?

ISRAEL: No.

TRUSTEE: So in other words you were just holding an open title. Is that right?

ISRAEL: I’m not aware what that means, but.

TRUSTEE: You bought it, you didn’t title it in your name and you sold it, and you just transferred whatever interest you had to somebody else.

ISRAEL: That’s right.

TRUSTEE: And the $8,500? What account did that get deposited into?

JENNIFER: I’m quite certain it was our Wells Fargo.

TRUSTEE: Which one? You have several Wells Fargo accounts.

JENNIFER: The main one, the Jennifer McKinney Photography, I would think. That was really all we used at that point.

Obviously this camper was a substantial asset that was sold prior to the bankruptcy and should have been included in the bankruptcy schedules. Jennifer tries to wordsmith and say that since the title wasn’t in their name, she didn’t think they had to disclose it. That doesn’t ring true.

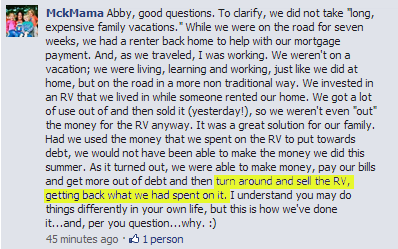

And Jennifer seemed to have a hard time remembering how much the camper was sold for, or when it was sold. Maybe Facebook can refresh her memory. On August 19, 2011, she posted the following in response to a question from a reader:

Did you catch that? She said “….getting back what we had spent on it.” You see Jennifer said in the creditors meeting that she used her PayPal account to purchase the camper in March 2011 for $12,000 from a man in Madison. If they “got back what they spent on it,” then that would mean that they sold it for $12,000, $3,500 more than Jennifer admitted to in the creditors meeting or the amended bankruptcy filing. (All of Jennifer’s August 2011 Facebook posts have been *mysteriously* deleted, but this screenshot exists thanks to the long memory of the internet.)

TRUSTEE: Any other property? Cars? Campers? Anything else that you sold, whether you held title to it or not?

ISRAEL: No.

TRUSTEE: No?

ISRAEL: No.

JENNIFER: From when to when, sir? What are you asking?

TRUSTEE: Six months prior to your bankruptcy filing.

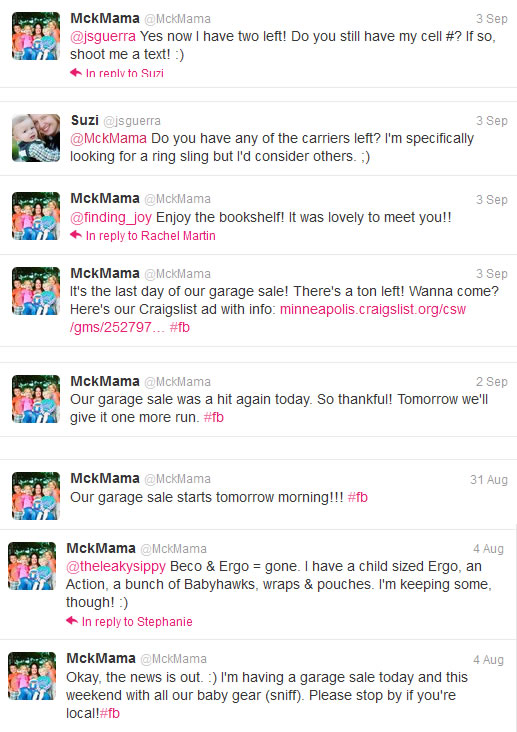

JENNIFER: No. We had the garage sale that you already asked us about, but . . .

TRUSTEE: You told me you sold little or nothing there, if I recall.

JENNIFER: Yeah, nothing of significance. A couple hundred.

TRUSTEE: A couple hundred bucks?

JENNIFER: Mm-hmm.[snip] TRUSTEE: When did they move out there?

LANDLORD: September 1st—let’s see, they showed up the first week of September; they just finished up having a big yard sale at their home in Becker.

It’s interesting that at the creditors meeting, the “little or nothing” was sold at the (1) garage sale. In reality, there were two (2) garage sales. One began on August 4, 2011, and one began on September 2, 2011, as shown by the below tweets.

So contrary to her assertion to the bankruptcy trustee that “nothing of significance” was sold, the Tweets at that time say something completely different. It exposes the two garage sales, mentions several specific items that were sold, and describes the second garage sale as “a hit.” Jennifer gave more information on Facebook about items sold at the September garage sale, as shown here and here. And please note that the second garage sale was held after the McKinneys had hired their bankruptcy attorney, so surely they would have known (or had the ability to know) that sales of assets needed to be reported to the bankruptcy trustee.

LANDLORD: Yeah, I didn’t know if I should be included in the bankruptcy because I have past bills or because we’re starting a new list of bills.

TRUSTEE: If you were owed money at the time that she filed bankruptcy you should have been included.

LANDLORD: I could be, right.

I have a separate case with them pending, to regain my rent that was owed to me for January.

TRUSTEE: Okay. Did they owe you any money before she filed bankruptcy in December 12th of 2011?

LANDLORD: At the time they filed I had, the last week of December, learned that they had not paid the gas bill out at the farm. It was four months of gas bill due so that was either going to be—that was going to be due to me if it wasn’t going to be paid so yes, they had four months of utility bills that was not paid.

TRUSTEE: When did they move out there?

LANDLORD: September 1st—let’s see, they showed up the first week of September; they just finished up having a big yard sale at their home in Becker.

TRUSTEE: So moved out there the first week of September, 2011.

LANDLORD: Right.

TRUSTEE: When did they first contact you about renting your place?

LANDLORD: Um, about the same time.

TRUSTEE: Okay. Within a couple of days?

LANDLORD: Uh, possibly maybe a week or ten days before that. They were actually maybe second or third on the list. I had an initial renter but that one didn’t work out, so I called them immediately.TRUSTEE: Okay. I remember something about rent being paid into escrow?

JENNIFER: Yes.

LANDLORD: Right. But I was getting a little bit suspicious around the Christmas holiday that this was maybe just an attempt to get out of rent, so that was—I have a lease agreement with them that they’re supposed to be paying the utilities out there. My suspicions were that they hadn’t been paying the gas bill and that they had used up nearly the majority of the $1,000 worth of propane in that tank. I called Rick Gappa Gas Service and they confirmed that they had not been out there once during that entire time period, to put in any gas. I had that sort of sinking feeling in my stomach that something was going on there.

I then learned about this bankruptcy case but only by accident. The papers that were being sent to me for this bankruptcy case were being sent to them. The postmaster recognized the mistake on it and had the papers given to my folks, and they were sent to me out in California, where they knew I was at at the time.

I, at that point in time, realized that I had—I felt like I had been lied to and taken for a scam. So around the middle of January, to make sure that I knew that I was sure about this, I called the electric company and learned that they had not paid any electrical bills out there. I checked with them again yesterday; they have not paid any electrical bills in the five months that they have lived there.

TRUSTEE: Okay.

LANDLORD: Nancy from the billing department was willing to come today and she’s willing to come to another hearing if she needs to testify to this. It’s well over $1,000 that is owed on the account out there.

I had an e-mail from Jennifer here in my file, from the first week of September, stating that she was putting the utilities and the propane in her name that day. It never happened. So altogether I did not get rent, I did not get the gas bill—or the propane bill.

I have since contacted Gary _____ who did snow plowing out there; he hadn’t been paid. And Corey’s Waste hadn’t been paid for picking up trash.

TRUSTEE: Okay. To the extent there’s any bills that were incurred after the bankruptcy was filed it doesn’t get discharged in the bankruptcy.

LANDLORD: I didn’t—

TRUSTEE: To the extent that there’s bills incurred after the bankruptcy is filed, they aren’t discharged in the bankruptcy.

LANDLORD: Yeah?

TRUSTEE: But to the extent that you think she owes you money from pre-bankruptcy debt, you have to get your own attorney to represent your interests. Alright?

LANDLORD: Right, Okay.

TRUSTEE: Anything else?

LANDLORD: Is there a time period that we’re supposed to submit the records to them, as far as the electric company now? I mean, are they out of that timeframe?

TRUSTEE: You’ll need to talk to your own attorney. I can’t give you legal advice.

LANDLORD: Okay.

TRUSTEE: Okay?

LANDLORD: I have a black refrigerator they left behind at my house. I’m not sure if it’s the one that they purchased, that they were speaking of here. I’m not sure what’s—if it belongs to the bankruptcy court at this point in time or if it belongs to me. It’s still sitting there, it’s full of garbage and it stinks.

JENNIFER: That’s the one that you agreed to buy. That’s why I left it.

LANDLORD: I agreed to buy it from them. I believe it worked at the time. I said I would give them $100 for it. They left it behind. It’s full of garbage and it stinks.

TRUSTEE: Did you give them $100 for it?

LANDLORD: I agreed that I would under the terms of the release of our bankruptcy, or, I’m sorry, the release of their escrow money. We had negotiated an agreement there and I thought that was going to be closed, and that was part of it.

Being the stand-up people that Jennifer and Israel McKinney are, they left trash and belongings behind for the landlord to clean up, failed to pay for gas or electric (more than $1,000 worth!), and then expected him to pay them $100 for a refrigerator full of rotting food. Typical McKinney scams.

Undisclosed Donations and Gifts

TRUSTEE: Let’s talk about some of your checks that you wrote. This is from _____ February 4th _____ – donation to a friend’s international adoption on February 1st, $1,000. Who’s that to? {31:24}

JENNIFER: Our friends Mark and Ann Durand. They’re from the Buffalo / Monticello area.

TRUSTEE: And you transferred to GNHI, humanitarian organization to Africa, $1,000?

JENNIFER: Yes.

TRUSTEE: You didn’t list that in your bankruptcy schedules under transfers. Why didn’t you?

JENNIFER: Under transfers?

TRUSTEE: Yes. It asks you if you did transfers of any assets.

JENNIFER: Okay. I guess I thought of it more as charitable giving and not—didn’t think of it as a transfer. Sorry I didn’t put it in the right spot.

So $2,000 given away but not reported on the bankruptcy schedules as required, with Jennifer claiming she didn’t think it was a transfer. And that she “didn’t put it in the right spot.” Not quite. Jennifer didn’t put it in any spot. It was completely undisclosed, in apparent violation of the bankruptcy laws.

TRUSTEE: What’s this Nancy Lee Brady gift for $300 from October 3rd. Who is that? Is that your _____? {41:19}

ISRAEL: That’s my mom.

TRUSTEE: Do you see on the Statement of Affairs it asks for gifts, number 7? List all gifts to family members.

ISRAEL: Uh yes, I see that and that would have been a mistake of mine. I thought that we had gone over that in our previous meeting. We didn’t.

JENNIFER: I think we had said _________ [background noise].

ISRAEL: No we had mentioned except for my mom and I said that I had made a check for—and I thought it was like $500 but it turns out it was $300.

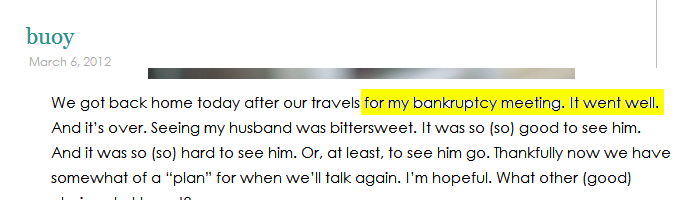

After all of the curious discoveries made by the bankruptcy trustee during the creditors meeting, Jennifer McKinney told the readers of the MckMama blog that it “went well”:

Really? The trustee busts Jennifer and Israel on lie after lie, and that’s considered “well”? I doubt any rational person could read that transcript and think that the hearing went well for them.

Following the March creditors meeting, the McKinneys filed amended financial information in their Chapter 7 bankruptcy, case 11-61215. And lo and behold, some substantial items that were previously undisclosed are now disclosed. I think it’s clear that only the discovery of these items by the bankruptcy trustee prompted this amendment.

Here is a summary of the assets on the original and amended filings, as well as other important information:

And here’s a handy pdf of the numbers for your own use.

While the assets in the amended schedules are only slightly higher than in the original filing, this is the case only because Jennifer and Israel are failing to disclose things or making false disclosures. Highlighted in yellow are the items that were undisclosed or inaccurately disclosed in the original bankruptcy filing. Highlighted in pink are the items that still have problems, even in the amended filing.

- PayPal Account – The first new disclosure is the “PayPal Account.” There are a couple of interesting point about this. How in the world is the balance unknown? PayPal provides complete histories, and Jennifer can look at this history and find out exactly how much money was in the account(s) on the day of the bankruptcy filing. Second, and more important, is the fact that there are at least 4 known PayPal accounts that Jennifer has used, not one.

- Domain Names – The value is lowballed, as discussed above.

- Jayco Travel Trailer – As discussed above, Jennifer disclosed in the creditors meeting and in this amended bankruptcy filing that the RV was sold for $8,500. According to a contemporaneous Facebook posting shown above, it is likely that it was sold for $12,000.

- Garage Sales – Jennifer still has not disclosed in her amended bankruptcy schedules the many items that were sold at two very public garage sales.

You see also in the amended bankruptcy filing, Jennifer McKinney changes the monthly income for the means test from $5,039 to $9,750, almost twice as much as originally reported. Yet in Schedule I, Current Income of Individual Debtor(s), Jennifer’s gross income from her business (blog, photography, deals) is still listed as only $1,500 despite the bankruptcy trustee showing the falsity of that number in the creditors meeting.

Are these non-disclosures and false disclosures in the bankruptcy filing of Jennifer McKinney and Israel McKinney important? YES!!! While the amounts may be small in some cases, the bottom line is that the bankruptcy law REQUIRES DISCLOSURE of these things. Jennifer and Israel McKinney do not get to decide that these items don’t matter. They MUST disclose them and let the bankruptcy judge decide what to do with them.

Do I think that the McKinneys just made “mistakes” in filling out their paperwork? NO!!!!

It appears to me that the non-disclosure and the inaccurate disclosures were willful. They have engaged in a pattern and practice of deception in their bankruptcy filing (and other financial dealings).

Again, bankruptcy is a very serious process, and the McKinneys had a legal duty to be careful with their disclosures. What they did seems to go beyond mistakes. They failed to disclose things, and hoped no one would find out. Even when confronted with the truth at the creditors meeting, Jennifer continued to lie about her income, the family’s assets, and when she received money.

I am pleased that the bankruptcy trustee, Gene Doeling, has filed an application for his law firm to assist with further action in the McKinney bankruptcy. The application states the law firm will:

Object to the debtors’ claim of exemptions, pursue turnover of property and to otherwise represent the bankruptcy.

One option for the bankruptcy court is to approve the McKinney petition for bankruptcy but seize certain assets, sell them, and give the money to the creditors.

I hope that instead, the bankruptcy court declines to discharge the debts of Jennifer and Israel McKinney, and they are saddled with these debts for the rest of their lives. According to the U.S. Bankruptcy Code (11 USC § 727):

(a) The court shall grant the debtor a discharge, unless—

(1) the debtor is not an individual;

(2) the debtor, with intent to hinder, delay, or defraud a creditor or an officer of the estate charged with custody of property under this title, has transferred, removed, destroyed, mutilated, or concealed, or has permitted to be transferred, removed, destroyed, mutilated, or concealed(A) property of the debtor, within one year before the date of the filing of the petition; or

(B) property of the estate, after the date of the filing of the petition;(3) the debtor has concealed, destroyed, mutilated, falsified, or failed to keep or preserve any recorded information, including books, documents, records, and papers, from which the debtor’s financial condition or business transactions might be ascertained, unless such act or failure to act was justified under all of the circumstances of the case;

(4) the debtor knowingly and fraudulently, in or in connection with the case—(A) made a false oath or account;

(B) presented or used a false claim;

(C) gave, offered, received, or attempted to obtain money, property, or advantage, or a promise of money, property, or advantage, for acting or forbearing to act; or…..

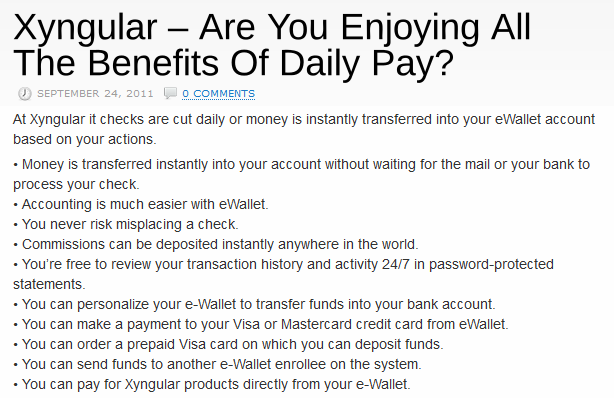

UPDATE #1: Since Jennifer McKinney began hawking Xyngular diet pills prior to the March 5 creditors meeting, it is important to keep tabs on this income. She has been bragging about how many people signed up under her and have purchased the product. Xyngular apparently pays its reps daily, and has methods available for transferring funds that may otherwise allow someone to fly under the radar with this income. Let’s hope the bankruptcy trustee digs into this issue so that the McKinney’s true income (and their true ability to repay their debts) is exposed.

UPDATE #2: Jennifer Howe Sauls McKinney has filed for legal separation in Wisconsin. The Affidavit for Temporary Order filed in court on April 3, 2012 states:

4. My spouse and I have not agreed on an economic arrangement during the pendency of this action, and there is a need for such orders as requested in this affidavit.

However, in the amended bankruptcy schedules filed on April 12, 2012, child support of $800 is shown as an expense on Israel’s schedule of current expenditures. Oddly enough, Jennifer’s schedule of current income doesn’t reflect $800 of child support each month. It still reflects the materially false and misleading figure of only $1,500:

Joint Debtor’s self-employment will be decreasing significantly as no online ads are being purchased. She expects her income to drop from $5000 per month to $1500.

Note that if Israel takes a deduction for child support paid, Jennifer should recognize it on Schedule I, line 10, since it is not a true “expense,” but is merely a transfer between debtors.

Update #3: During the March 5, 2012 creditors meeting, Jennifer was asked about a payment made on the house after the bankruptcy filing:

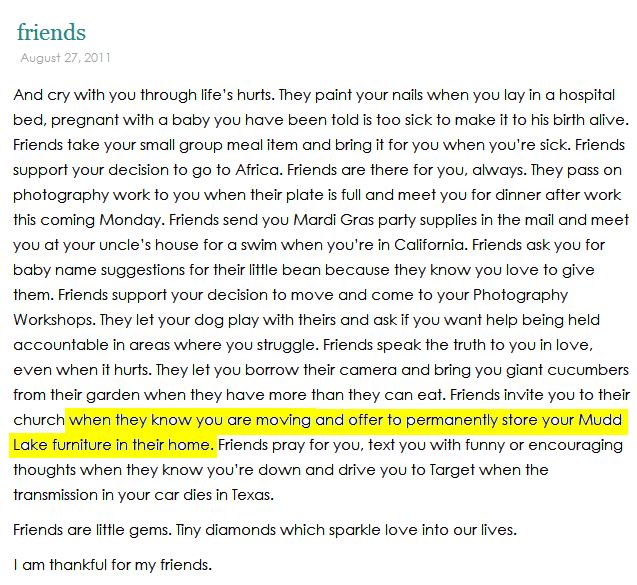

TRUSTEE: According to your list here on 8/26, which is four days after you hired your attorney to file bankruptcy, there’s a payment, according to your notes, to Central Bank for $6,248.52. Right?

JENNIFER: Mm-hmm.

TRUSTEE: So what are you paying Central Bank over $6,000 for, four days after you hired an attorney to file bankruptcy?

ISRAEL: Two months of mortgage.

TRUSTEE: Why are you paying the mortgage when you know you’re going to file bankruptcy?

JENNIFER: Because we weren’t planning on leaving our house.

TRUSTEE: How many months behind were you?

JENNIFER: Just like half a month. _____ they had the money. I remember saying “well I’ll pay this and I’ll go ahead and pay next month so I don’t have to worry about . . . ”

But a blog post on August 27, 2011 refutes the claim that they weren’t planning on leaving their house. Just one day after the payment “…because we weren’t planning on leaving our house,” Jennifer said that “friends invite you to their church when they know you are moving.” How could friends have already known the McKinneys were moving and have invited them to their church, when just one day prior Jenni says they weren’t planning on leaving their house? (And please note the mention of friends permanently storing their furniture from Mudd Lake. The bankruptcy court might want to look into that as well.)

So the trustee gave her a chance to amend her 2011 income, after concluding what income/assests they found during the trustee meeting, and she still got it wrong? I’m assuming her lawyer was in on that meeting too? Are there any reprocussions for ms. McKinney or her lawyer, for still incorrectly filing the amended papers? I mean besides the potential charges of intentionally hiding assets and income, etc?

Yes, criminal charges are possible, although they are not too common. I’m not a lawyer, but I think this case is a good candidate for potential criminal charges, however, because of how egregious the violations are.

This is a good example of a bankruptcy case in which criminal charges were brought:

http://m.jsonline.com/more/news/watchdog/137356988.htm

Jennifer may want to pay attention.

Very interesting read and very well written.

Thank you, thank you, thank you for taking what must have been a huge amount of time to research and write this article! I have been following the MckMama blogging train wreck for years now and can’t believe she’s still around. This latest mess just boggles my mind. It’s so transparent that she hid assets and income–I really hope the trustee for the case sees through her lies and fraud. Thank you again!

You’re welcome! You’re right.. it did take quite a bit of time but it was worth the effort. The MWOP blog was extremely helpful to my work, and I wrote this because I believe Jennifer McKinney needs to be held accountable for her actions. No longer can she claim that the “mean girls” are just picking on her. The numbers don’t lie, but Jennifer sure dues.

Yes. This. “No longer can she claim that the “mean girls” are just picking on her. The numbers don’t lie, but Jennifer sure does.” Thank you!

Oh my goodness! Is there any way to forward this article to the Trustee? I think the way all this info is organized so well would be helpful to him in pursuing charges against those scammers!! They truly deserve to go to jail.

Another fascinating PayPal issue with this bankruptcy has been uncovered over on MWoP. Evidently MckMama and MckDaddy have several different PayPal accounts between them. Money (a penny here, a dollar there) was sent to various alternative e-mails discovered belonging to Jennifer and Israel. All of the e-mails evidently have PayPal accounts associated with them. Jennifer stated she has/had several Wells Fargo accounts, and each could have been used to fund a PayPal account. God only knows how much money Jennifer has spread out across those PayPal accounts and what banks they transfer into when she withdraws money.

Her Xyng distributorship also permits daily payments in the form of pre-paid credit cards – another handy way for her to keep her income off the record for a while.

She’s a piece of work. I’m glad someone other than MWoP has taken notice of her criminal activities. Because as you say in an above comment – she can dismiss so much of the scrutiny she receives as being the work of haters and mean girls. She’s operated on the wrong side of good and the back side of legal for a long time. It will be good to see the courts hold her accountable.

Not illegal, but it was discovered that she created fake fb and twitter people to compliment her and go on the defensive against any negative comments. Stephanie Gerber is actually Jennifer Mckinney.

A revealing, eye-opening article about the devious, scheming entity that is Jennifer & Israel McKinney. Those 2 need to be punished for such actions. Regardless of what she thinks, they are NOT above the law, & hopefully will pay the price. Sooner or later, hopefully sooner.

The Amazon links have been on the deals page since it started. She even made a Father’s Day post on the blog full of Amazon links. There is no disclosure, even thought she told the trustee she can’t use links without disclosing them.

The difference between the $12,000 they paid for the RV and the $8,500 they resold it for is $3,500, not $2,500.

The in-person photo classes started August 13th. She posted a blog saying she was teaching the first one.

Thanks for catching the typo, Jenny!

This is an excellent piece of work! Very precise and detailed and professional.

One very small thing:

You said:

Did you catch that? She said “….getting back what we had spent on it.” You see Jennifer said in the creditors meeting that she used her PayPal account to purchase the camper in March 2011 for $12,000 from a man in Madison. If they “got back what they spent on it,” then that would mean that they sold it for $12,000, $2,500 more than Jennifer admitted to in the creditors meeting or the amended bankruptcy filing. (All of Jennifer’s August 2011 Facebook posts have been *mysteriously* deleted, but this screenshot exists thanks to the long memory of the internet.)”

Wouldn’t that be a $3500.00, not $2500.00?

Yes, thank you, it’s been corrected.

[…] http://www.sequenceinc.com/fraudfiles/2012/04/mckmama-fraud-jennifer-mckinney-bankruptcy/ This entry was posted in Uncategorized. Bookmark the permalink. ← MckMama Creditors Meeting Audio Recording […]

http://bit.ly/J7Lqu8

This is a link to a cached version of a blog post by Jennifer on 8/27/2011 regarding more assets of value (high-end vintage furniture from a boutique called Mudd Lake) that are undisclosed in the bankruptcy paperwork – both original and amended.

I also failed to mention that the same blog post linked in my previous comment also talks about an in-person photography workshop from that day. So, her own words verify she was holding these as early as AUGUST, 2011.

GREAT job. I was sucked in by Jennifer’s cute kids and YAY God non-sense…even defended her early on to the “nay-sayers”. When I started noticing her inconsistencies, and her double talk non-sense, I started looking into the “nay-sayers” claims, and have been reading the various incarnations of MWOP.

I truly can’t believe that her followers continue to believe her bold lies. How can you continue to defend a woman who posts about bankruptcy one day – and the next posts about staying in expensive hotels and driving around the country and trips to Las Vegas?

I’m skeptical that she’ll suffer any Federal fraud charges over this…but I REALLY hope the eyes of her followers are opened to what a despicable human being she is, and to the fact that she’s been scamming them – for YEARS.

Thank you. I don’t know if any legal action will be taken against the McKinney’s, but we can hope. At the very least, those who WANT to know the truth can see it in black and white here.

I hope this is being forwarded to trustees. Thanks for the excellent article.

With all due respect, only the parties directly involved in this case have all the facts. In this country we are all entitled to due process. As I’m sure you know there is a ton of stuff that goes on behind the scenes of which are not part of the public record. Correspondences, conference calls, conversations in Court, oral arguments etc. etc. The only people that are privy to all of the information in this case are the McKinneys, their attorney Patty Wisecup, Judge Dennis D. O’Brien and the trustee/Gene W. Doeling. I think it would be prudent to let the system work. However this plays out is clearly in the hands of Judge Dennis D. O’Brien. As it should be. At this juncture this is a bankruptcy case. Nothing more, nothing less. No charges to date have been brought against the McKinney’s. Innocent until proven guilty is a mainstay of our Constitution. Whatever the Court decides, it decides. I suggest we let the system work and not be participants of internet arm chair conclusions. I mean does anyone out in cyber world really think they know everything about the McKinneys? Really? It’s the internet. Enough said.

What does cause me much concern about this presentation is that the majority of the information presented here relies almost entirely from the MWOP blog which is anything but a reputable site. In all fairness, I would appreciate it very much if you would read up on a presentation that I did that showcases the actions of MWOP, who are beyond disturbing and rabid in their treatment of Jennifer McKinney & her entire family. A hater blog that has deliberatly and purposefully done everything in their power to lower Jennifer McKinney’s income. I mean that’s fair, right?

I felt compelled to contact the Court after realizing that members of MWOP were actively contacting the Court themselves. That being said I opened up my profile page on Facebook and published my writings to the Court as well as a few other things. It is open to the public. I do hope that other view points are accepted here and are not censored.

Links:

https://www.facebook.com/profile.php?id=1457866640

https://www.facebook.com/profile.php?id=1457866640#!/profile.php?id=1457866640&sk=photos

Thank you,

Barbara Murtha Malley

Sorry Barbara, but you are mistaken in your assumptions. While MWOP did provide excellent information in the form of timelines and documents, I evaluated everything before posting it. The information here is the cold, hard evidence found in court filings and in Jennifer McKinney’s own writings on her blog and Facebook. I have heard the recording of the creditors meeting, and the transcript is accurate.

Yes, we will have to wait for the system to work. However, there is no reason why interested taxpayers should not participate in researching the issues and assembling the evidence. You may have noticed that I work as a fraud investigator, and I am very experienced in these types of matters. I was happy to be able to use my skills in fraud examination to evaluate the numbers and the evidence. Now it is up to the trustee to take action, and I am hopeful that he will pursue these issues vigorously. Abuse of the bankruptcy courts should not be allowed.

I have looked at your materials. They have absolutely no relevance to the bankruptcy filing or any of the evidence provided here.

Thanks for not censoring my comment Tracy.

I disagree with you that MWOP’S cyber bullying/harassment/stalking of the McKinney’s have had nothing to do with the McKinney’s filing for bankruptcy. Prologned bullying can affect the victim in every aspect of their lives, on every level. That includes managing your day to day life (including finances) and family relations. On top of that it can cause stress, Chronic Fatigue Syndrome, PTSD, Suicide, IBS, Psychiatric injury etc. Each and every one of these scenario’s have it’s own list of symptoms which affects a person on a day to day level.

I have never before in my life seen the level of bullying that the McKinney’s have endured. That being said, it wouldn’t surprise me one bit that the prologned bullying that the McKinney’s have endured have had enormous ramifications for them that no one out in cyber world can even begin to imagine.

On top of that at the same time MWOP has contacted Jennifer’s sponsors and driven away business it has affected her main source of income, which is her blog. They have also made it a campaign to target and harass anyone they deem as standing up for Jennifer on any level to the point of contacting Jennifer’s blog & Facebook readers to try and intimidate them and drive them away. Once again to lower her “numbers” which in turn affects her income.

This is a new venue for them, contacting you.

It just baffles me that anyone out cyber world thinks they know the whole story and have taken it upon themselves to convict the McKinney’s on the internet. I would venture to say to people to stop the mud slinging and let the system work.

Barbara – While I have allowed your comments through thus far, I will not allow you to use this article as a forum for saying untrue things about the situation.

That being said, I don’t think anyone would claim that “bullying” (if that’s even what you can term the actions of those exposing all of Jennifer’s lies and inconsistencies) doesn’t affect people. But the bottom line is that is irrelevant to the facts in the bankruptcy. The bankruptcy court only cares about the numbers, and Jennifer has lied repeatedly about them, even when being confronted by those lies in the creditors meeting. That is really all that matters for this article. I am exposing the truth about the numbers, and making no comment about whether people like Jennifer McKinney or say mean things about her.

I would also like to point out that the financial irresponsibility of the McKinneys started long before the criticism of MckMama. The first foreclosure happened in 2008. The unpaid income taxes date all the way back to 2006. Jennifer and Israel needed no help from anyone to get themselves into those messes.

Further, Jennifer’s income has NOT suffered for any reason other than her own actions. She lost the BlogHer contract because of her plagiarism. The naysayers didn’t make her do it. And you can see that her income has NOT been impacted by the alleged bullying. The first site about MckMama did not start until July 2009. Look at her income in 2010 and 2011 (I mean the REAL income for 2011) and you will see that she is making much more than she was in 2009.

Finally, if the “bullying” is too much for Jennifer, she has two simple courses of action to stop it.

1. Stop lying. This is the easiest action.

2. Stop blogging. She has other options for employment, including her photography, teaching, or hawking dangerous diet pills.

The system can only work if it has the entire truth. How can the system work when it is basing its knowledge to form a judgement on half-truths, out right lies, omissions, or undisclosed assets?

While there may be some aspects of the negative comments directed at Jennifer that could be defined as bullying, the majority are based on her lies, omissions, and half-truths.

No one “did” this to Jennifer, she allowed this happen and now she is facing the ramifications of her actions!

Barbara ~

Jennifer has said many times that she doesn’t read MWOP, so how could anything said there possibly affect her health?

If she is experiencing any sort of physical stress, I would venture to guess it is caused by the hole she has dug herself.

Oh, Barbara.

It doesn’t matter that the MWOP people are mean. What matters is that Jennifer lied. Not once. Not twice. Not just to her fans. But under oath. I don’t think that’s what Jesus would do. Do you?

Barbara, I don’t see what innocent until proven guilty has to do with a bankruptcy case. The information on this post is based on published court documents. Your photo album is full of your own assumptions and generalizations. Please read the credentials of the owner of this site. She wrote a serious examination of a court preceding made by a qualified professional, and you’re trying to turn it into a three-ring circus.

And nothing anyone could have done or said to or about Jennifer McKinney justifies omitting assets and income in her bankruptcy filing.

Ok, but documentation shows that Ms. McKinney made over $117,000 last year (which she failed to disclose). If the supposed “hater blog” sought to significantly reduce her income, it doesn’t seem to me that they did a very good job.

According to the testimony at the creditors meeting, the income for 2011 was $148k plus the (still undisclosed) affiliate income.

Exactly Barb. It is a bankruptcy case. Why then did you feel that photos of the McKinney’s home, children & goats in tutus were in any way relevant to the case, not to mention what a “wonderful” parent Jennifer is or all the screen shots from her naysayers. They had no relevance nor bearing whatsoever.

The facts are that the McKinneys spent well beyond their income, even prior to Jennifer’s (in)fame. That they continued to rack up debt when they had the means to pay & didn’t is relevant to any taxpayer as they are footing the $3/4m debt.

Also relevant is that the McKinneys omitted vital information as well as outright lied about future income in order for the bankruptcy to be approved. This is illegal & should be dealt with accordingly.

You know Barb, you want us to sit back and let the court do their jobs. But you are the one who is bothering the judge with your ridiculous letters. At least all of us are just keeping to ourselves her on the internet. Why don’t you take a little taste of your own medicine and let the court do their jobs and stay out of it. Can’t you tell that everyone dislikes you just as much as we all dislike Jennifer? The things that have been submitted here and on our precious MWOP blog are only copies of public information and recordings of the court hearings. We are not making anything up. Simply bringing the truth to light.

Oh, poor, poor Jennifer. Railing against the ebil President Obama for his “socialist” ways whilst coasting on the tails of the good Americans who do pay their taxes and earn an honest living. She doesn’t know a thing about personal responsibility or hard work. She’s slamming honest taxpayers with her slimy, cheating, manipulating ways. Jennifer: PAY YOUR OWN DAMN DEBT! You sat on your ass and raked in over $140,000 last year and have the gall to sit and smugly deny and deflect? If you think for one second that Jesus would approve of your BS you are so sadly mistaken. Grow the hell up.